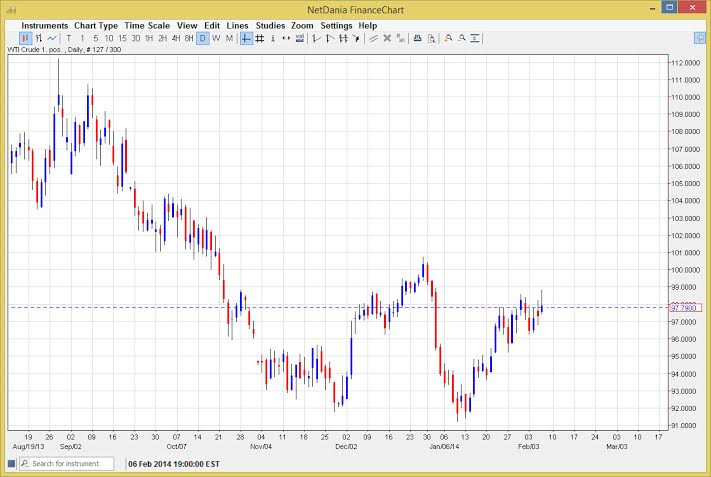

The WTI Crude Oil markets try to rally during the session on Thursday, but as you can see struggle do just below the $99 handle. That being said, the $99 handle of course had been supportive in the past and the fact that we pullback informed a shooting star would normally be a very negative sign. However, with nonfarm payroll coming out today it’s very likely that the market is just simply pulling back out of respect for the potential volatility that we will see coming into the marketplace at 830 Eastern Standard Time as the announcement comes out.

Looking forward, I still believe that this market will try to hit the $100 level, and any pullback at this point time is probably going to be a buying opportunity. The $96 level still looks supportive to me, and because of that I am in fact looking to buy this market on any type of pullback. I believe sooner or later we will hit the $100 level, but I firmly believe that we may very well break above that as well. If we do, we would have just finished a “W” pattern, and that of course is very bullish in and of itself.

Even if we fall, we won’t do very much damage.

I believe that even if we do end up falling from here, there is plenty of support in this marketplace to simply make it a matter of consolidation, not bearishness. The market has sold off of the last several months, but if you look at the chart, you can see where we have certainly slowed down the dissent, and now have started to go sideways overall. With that in mind, I believe that the downtrend is broken at the moment, and now we have to see whether not the buyers can step in and take control. I believe they eventually do, based upon either a weakening US dollar because of poor jobs numbers, or strengthening economic outlook and demand picture because of a strong number as it would suggest more manufacturing in America. Either way, oil probably goes higher.