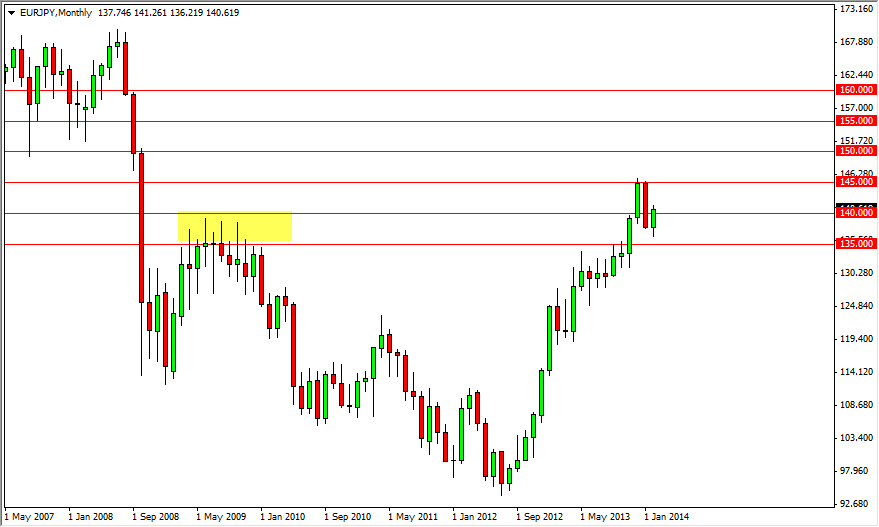

The EUR/JPY pair had a positive month for February, after getting beat up severely during the month of January. However, and less you look at monthly charts, you may not recognize that the massive selloff during the month of January was essentially a return to the previous breakout level. This is classic technical analysis, as we will often test a previous resistance level for potential support. That support essentially “proves the validity of the breakout.” If we have that, and it would appear that we do, this is a very bullish sign for this market. Because of this, I am very, very positive when it comes to this pair.

If you look at my forecast for the month of March in the EUR/USD pair, you see that I noticed that the 1.38 level might be massive in its implications as to the strength of the Euro. I think if we can get above that level, this pair should just absolutely skyrocket. This is because unlike the US dollar, the Japanese yen does not have any tapering to back it up. So if the Euro can do well against the US dollar, it should absolutely pummel the Japanese yen.

145

I think that we are going to the 145 level. Quite frankly the only real question I have for the month of March is whether or not we can break out above that level. I think we’re going to, the question is whether or not we going to this month. In fact, I fully anticipate seeing this pair hit the 150 level over the course of the next several months. If we get signs of significant global growth or if the German economy continues to improve, we could go to the 155 level this year as well.

I believe that pullbacks are buying opportunities in this market, and for those of you who are patient enough not to over leverage yourself right away, you can add to your position quite comfortably going forward. We have without a doubt broken out to the upside, now it’s just a matter of timing more than anything else. By cutting back on the leverage a little bit, you allow yourself more time.