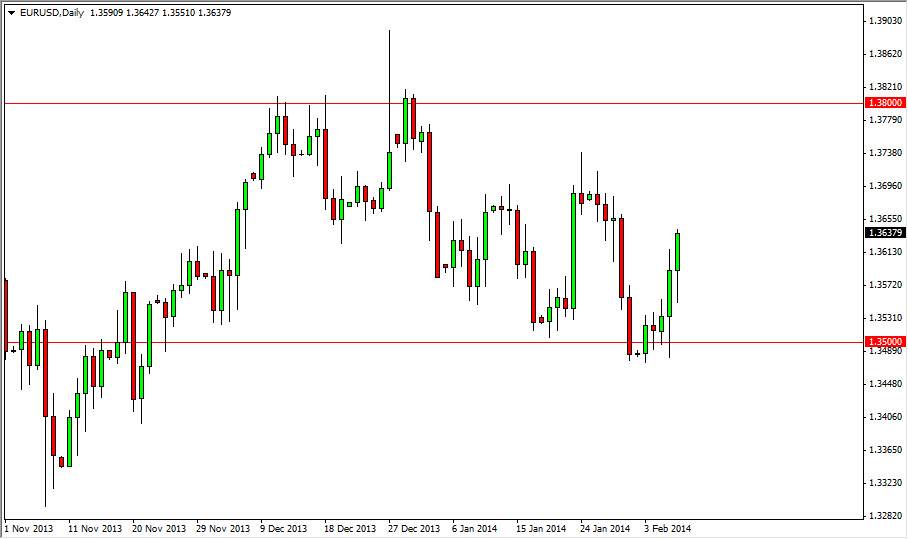

With the nonfarm payroll numbers coming out on Friday, the EUR/USD pair did in fact go back and forth quite a bit like one would expect. Initially, the market had sold off a bed during the early hours, but as you can see found enough support at the 1.3550 level to turn back around and bounce significantly. In the end, we had a candle that looks a bit like a hammer, and it probably suggests that the market is in fact going to continue going higher. The real question at this point in time now becomes whether or not we can continue going higher for much longer, or are we going to be stuck in a 200 point consolidation range?

Looking above, I can see that the 1.37 has in fact been resistive, and it wouldn’t surprise me if it was again. Above there, we have significant resistance at 1.38 as well, so it appears that any move higher is probably going to struggle a bit. Even if you got the move higher and were long of this market, you would have to expect a lot of volatility and choppiness in order to hang onto the trade for any type of significant profit.

Momentum will be needed

I believe that in order to go much higher, momentum will be needed in this market. Simply put, there’s far too much noise above to be overly confident about going long, although I do think that ultimately we do go to the upside of it. However, there are enough issues in Europe and America right now to keep this market somewhat stagnant. With that, I honestly haven’t been trading this pair too much, simply because it’s not worth the headaches that it can cause these days.

All things being equal, I suppose I would prefer to be long of this pair, but in the end I think that you wish to play the Euro, you might want to do it against the Yen, as that pair is a much cleaner play.