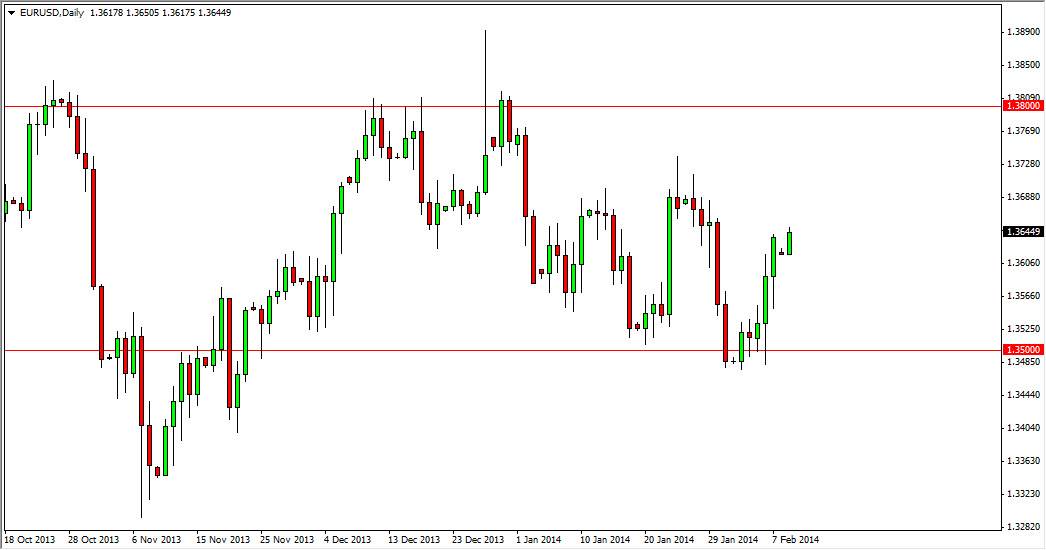

The EUR/USD pair rose during the session on Monday, but remained relatively close to where we closed on Friday. After all, we did gap lower at the open, albeit just slightly. With that, it appears that there was a bit of sluggishness when it comes to positivity involving the Euro. This tells me the market simply has no real conviction at the moment, and the fact that we have so much in the way of noise just above tells me that it’s probably pointless to start buying here. With that, I am very un-interested in this pair at the moment and believe that the market is probably going to be the playground for short-term traders at best.

Since I’m not a short-term trader, it’s difficult to find anything to get excited about at the moment, as I think scalping is probably the best you can ask of this market right now. The 1.37 level should offer resistance, and on top of that I believe that there is probably going to be resistance all the way to the 1.38 level. Because of this, the upside is very difficult to play at the moment, and I believe buying at lower levels is probably about as good as you can do right now.

Pullbacks that show signs of support could be buying opportunities, at least for the moment.

I believe that pullbacks in this market could be buying opportunities, if we get supportive candles. However, I don’t think that they are going to be long-term trading opportunities, as the market will more than likely continue to bank around between the 1.35 level on the bottom, and the 1.37 level on the top. If we get lucky from a bullish standpoint, we might reach the 1.38 handle. Above there, there is a ton of resistance, so it’s almost impossible to imagine a scenario in which this market go straight up, and as a result I will be playing the Euro against several other currencies instead of the US dollar. One particularly interesting one is the Japanese yen, as a move above the 140 handle is probably going to start another leg higher. As for the Euro against the US dollar, I think there’s far too many moving parts at the moment.