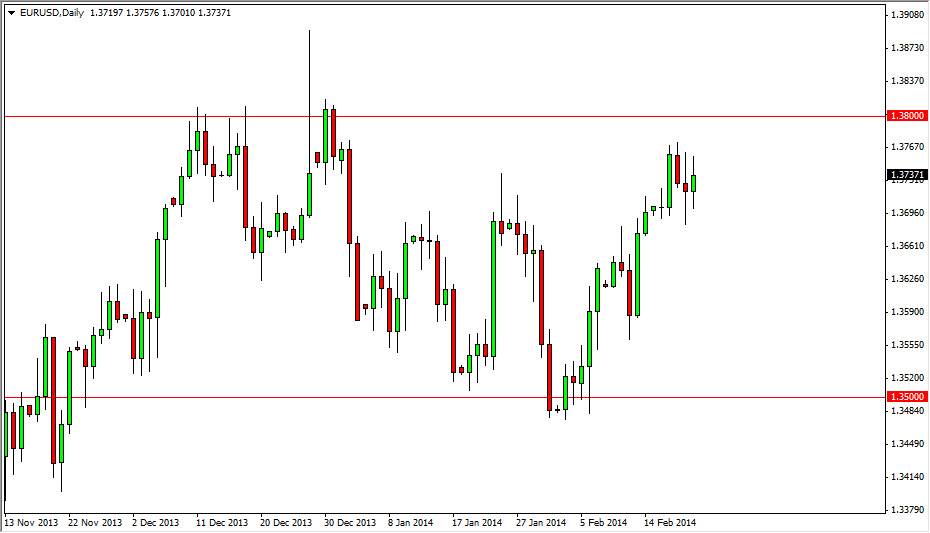

The EUR/USD pair went back and forth during the session on Friday, essentially hovering above the 1.37 level yet again. The biggest problem I have this market right now is that it seems like it’s simply “stuck” at the moment, as there is significant support at the 1.37 handle, and most certainly significant resistance at the 1.38 level. In other words, this really nowhere for this pair to go right now. It is because of this that I’m sitting on the sidelines but I do have a couple of levels that I am paying attention to.

A break of the 1.38 level would of course be bullish but I believe that there is a significant amount resistance all the way to the 1.40 handle. Because of this, even if the Euro does start to climb, it’s going to be very difficult pair to trade. Part of this is predicated upon the idea that the Federal Reserve will continue to taper off of quantitative easing, which of course is good for the US dollar overall.

Remember, you are trading relative value.

If you think about the fact that you are comparing two currencies, it doesn’t necessarily mean that you have to trade them against each other. In other words, if the Euro continues to grind higher against the US dollar but not necessarily in a fashion that makes you want to start risking trading capital, you can trade the Euro against other currencies. I have been doing this exact same thing, as the EUR/USD has essentially become a tertiary indicator for me. If I see this pair rising, I’m interested in buying the Euro, but not necessarily against the Dollar.

If you think about it, it makes sense of the Euro is going to struggle against the US dollar anyway. After all, as the US tightens its monetary policy, that creates a demand for US dollars. While the Euro can certainly continue to appreciate against it, you’re much better off using this is a signal to buy the Euro against weaker currencies. In fact, it is exactly what I’ve been doing.