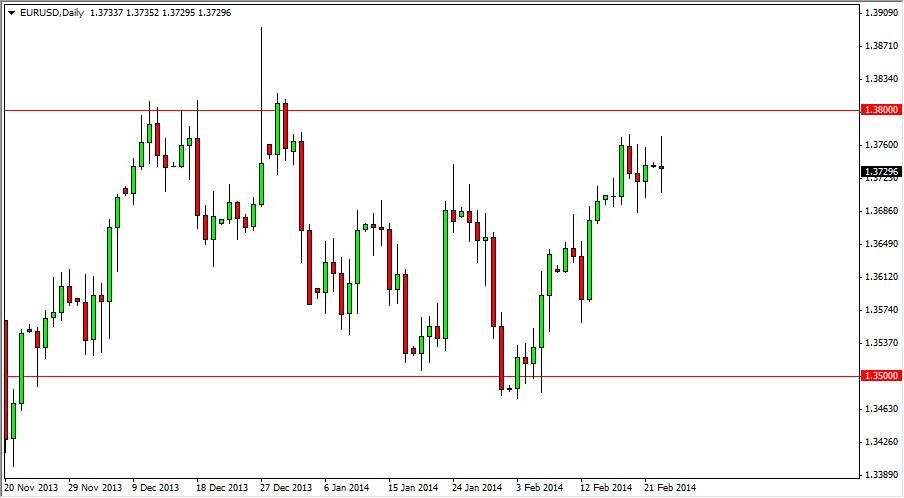

The EUR USD pair went back and forth during the session on Monday, essentially settling nothing. However, we did show the 1.37 level to be supportive still, and as a result I believe that we are still in the consolidation area that is bordered by both that level, and the 1.38 level on the top. Because of that, the market should continue to be fairly choppy and be the affair of short-term traders, which of course keeps me out of the market as I choose not to sit in front of the computer all day. That’s essentially what you will have to do in order to trade this pair, but that’s not to say that this market isn’t worth following.

Triangulation sometimes is the key to Forex trading.

Triangulation can often lead to significant profits, but only if you understand the concept. For example, if you will wish to trade the Euro or the Pound against US dollar, it makes sense to watch the EUR/GBP pair at the same time as well. Why you ask? It’s a simple a premise really: because whichever one of those currencies is presently favored in that pair should do better against the US dollar. This is the same as the weaker of the two. So for example, if you find that you want to sell the US dollar against a European area currency, and you happen to notice that the EUR/GBP has been going higher for the last couple of weeks, it makes sense to buy the EUR/USD. That’s simply because the Euro is stronger than the Pound. You are taking advantage of US dollar weakness and matching it up against Euro strength. It’s not that the GBP/USD couldn’t provide profits, but all things being equal the EUR/USD pair should move farther because of the inherent Euro strength.

That is essentially what I am using the EUR/USD pair for right now. Not to trade the Euro against the US dollar, but rather to trade the Euro against other currencies. On a positive day, I know that the Euro should do quite a bit better against the Yen, or perhaps the Canadian dollar. With that being said, I am still watching this market for an impulsive candle that tells me which way to trade, but in the meantime I am simply using it as a tertiary indicator for other markets.