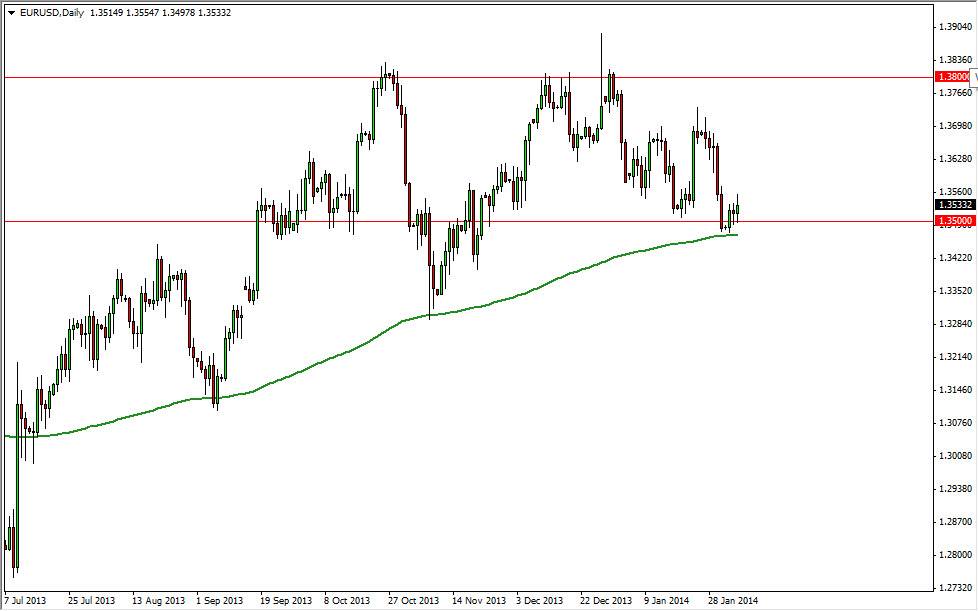

The EUR/USD pair had a back and forth session on Wednesday, but most importantly favored the 1.35 level as support. That being the case, it appears that the market will find buyers down at this level, especially with the nonfarm payroll numbers coming on Friday. After all, who exactly would want to start aggressively shorting this market with that massive announcement coming in just two days?

On top of that, you can see that the 200 day exponential moving average just below the current trading area, and that of course is one of those things that longer-term traders will pay attention to. The longer-term traders of course tend to hold the larger amounts of money in the market, thereby driving the overall trend. Certainly, the trend has been to the upside if you look at it through the prism of the 200 day EMA, so it makes sense that the market may have a little bit of support down here.

Nonfarm payroll report.

It is my opinion that the nonfarm payroll report will dictate where this pair does next. Granted, there is an ECB meeting but at the end of the day unless they do something massive, I still think that the jobs situation in the United States is still the most important thing. With that, I see the 200 day moving average as support, and as a result would not sell this pair until we close below that on a daily candle. On the other hand, buying is difficult as well, simply because of the fact that we have that unpredictable announcement coming out on Friday, but if I have to look at this chart and pick a direction, I believe that this is an area where we would have massive support. With that, then we certainly would continue to go higher.

Just how high can it go? I see 1.37 as the next major resistance area. Because of that, I think that will probably still remain somewhat choppy, but understand that the market probably has more of an upward bias at least in the next couple of sessions.