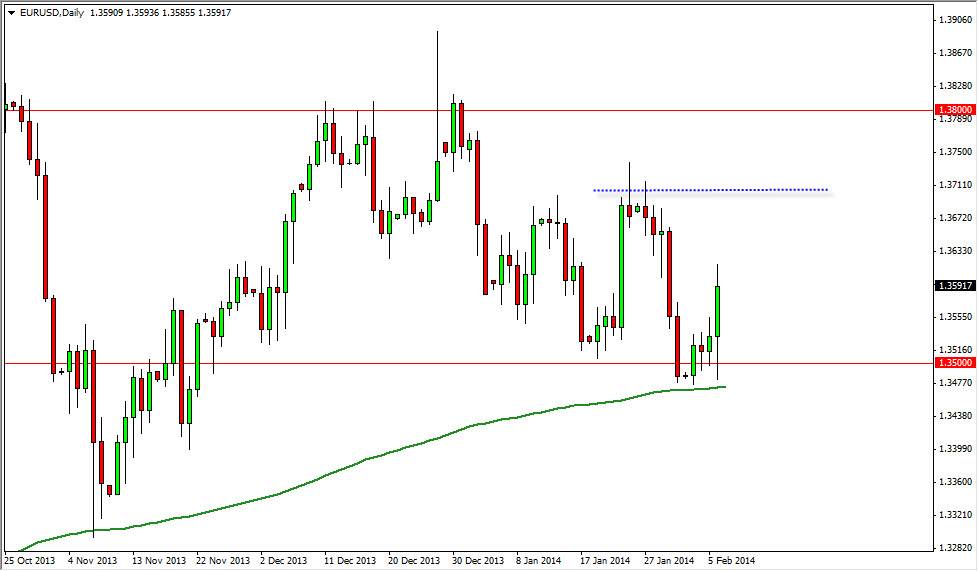

The EUR/USD pair initially fell during the session on Thursday, but as you can see found support at the exact same spot that we’ve seen over the last several sessions. Just below the 1.35 level there is an obvious amount of buying pressure, and on top of that you can see that the 200 day exponential moving average is situated just underneath it. The support push the market high enough to test the 1.36 handle, and as a result I believe that the market is in fact going to go higher. I know that the nonfarm payroll number comes out later today, so it is worth noting that the volatility could be extreme, but in the end it does look like a market that wants to go higher.

On top of that, although it is at the same market, the GBP/USD pair has formed a three hammers in a row. I think this suggests that the US dollar is probably going to weaken overall, and that normally means good things for this pair as the Euro is considered to be the “anti-dollar.” With that, I believe that any pullback that stays above the 200 day exponential moving average has to be seen as a potential buying opportunity.

Short-term opportunity

However, I do believe that this is a short-term opportunity. Having said that, I think that the 1.37 level will offer enough resistance to keep a bit of a lid on this market. Maybe not long-term, but enough over the next couple of sessions. With that, I would buying short-term pullbacks on signs of support off of short-term charts. Daily candles of course matter, but I think we’re going to continue to chop around overall, and that means that the market is still going to be a bit difficult to deal with.

If we managed to close below the 200 day exponential moving average, is at that point in time that I feel that the Euro would be in serious trouble. The first stop on the way down would be the 1.33 handle, but to be honest I believe that the market is already showing what it wants to do, so I think there is much more risk to the upside than anything else.