By: John Ursus

Timeframe: H4

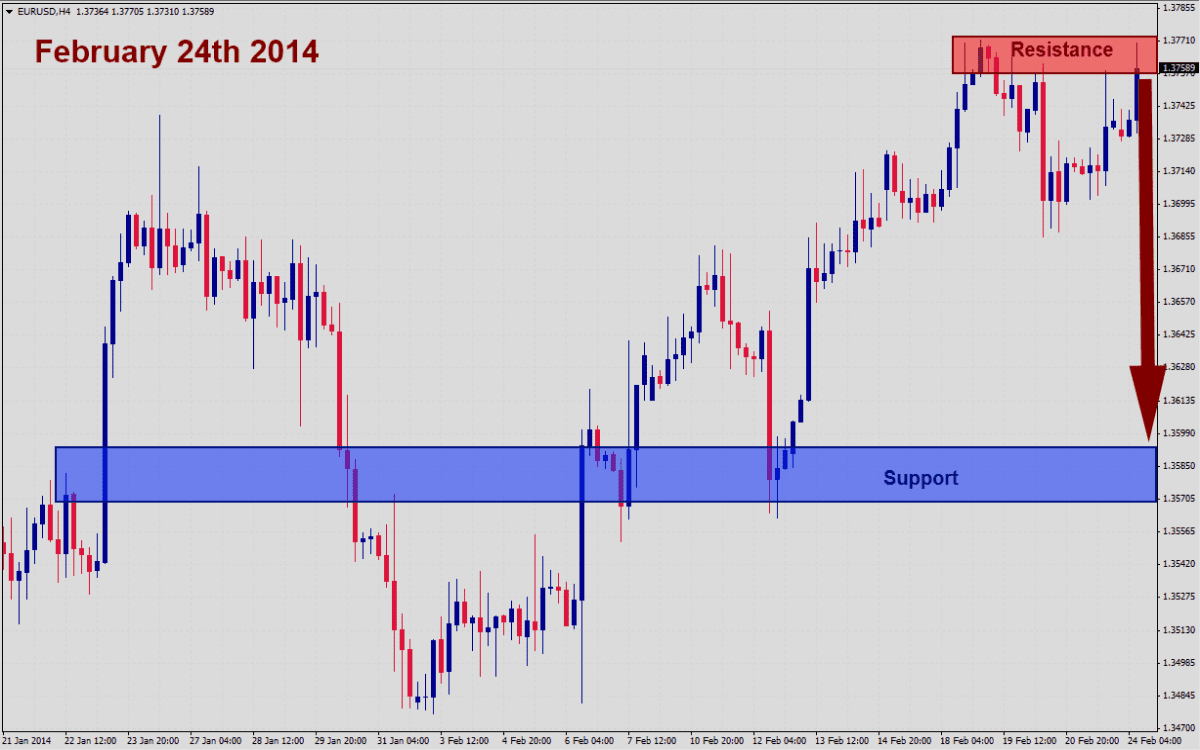

Recommendation: Short Position

Entry Level: Short Position @ 1.3750

Take Profit Zone: 1.3500 – 1.3550

Stop Loss Level: 1.3850

The EURUSD has rallied as visible in this H4 chart. The sharp move higher was fueled by a set of economic disappointments out of the US which point to a very slow start for the US economy in 2014. Most notably two consecutive disappointments out of the non-farm payrolls data in the US have painted an economy which is not nearly as strong as previously anticipated.

In addition regional manufacturing reports disappointed across the board and further illustrate underlying weakness in the US economy which may prompt the US Federal Reserve to slow down its tapering which it began two Fed meeting ago at which it reduced the current economic stimulus by $10 billion each down to a monthly total of $65 billion.

After the economic disappointments a growing number of forex traders expected a slowdown in tapering and should the next non-farm payroll report disappoint the Fed may decide to pause tapering altogether which is a very negative sign for the US economy and therefore the US Dollar.

Price action is in the process of forming a double top formation which is a bearish signal as a double top formation could signal a reversal in the current which may be short-lived given the US economic uncertainty. The overall trend will remain bullish and the EURUSD may approach the 1.4000 mark after a counter-trend correction will flush out short-term bearish pressures which would open the way for the next move higher.