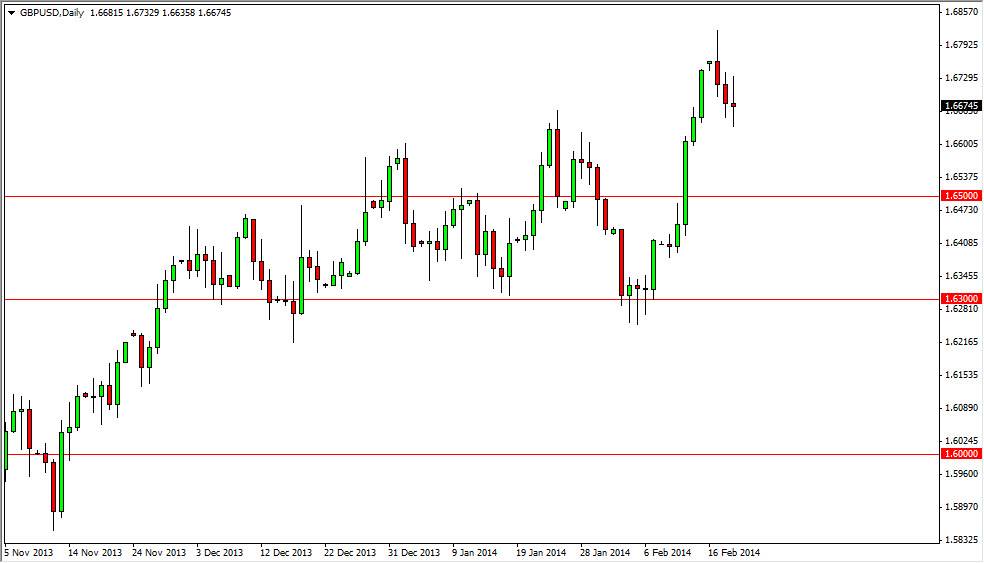

The GBP/USD pair went back and forth on Wednesday, essentially settling nothing by the end of the session. With this, it appears that the sellers might be running out of room and steam to continue to push this market lower. Because of this, I believe that the market will eventually present a buying opportunity as the 1.66 level should be one of interest. The buyers will step in, as there are certainly going to be people that have missed out on this latest breakout, and would certainly know that we are in the middle of it by now.

The British pound continues to be a currency that I want to own. Granted, the US dollar isn’t exactly weak at the moment, so I think this pair might be strong – but the Pound will fare better against other currencies than the Greenback.

The dips are gifts.

Any time this market pulls back, I am looking to buy it on those dips. I think that the market will continue to grind higher, but you have to be willing to be patient. That patience should reward you though in the long run, as I believe this pair goes to the 1.70 level. That is my target, but I am not thinking that it is going to be hit anytime soon. In fact, I suspect that best way to take advantage of this move is to buy it over and over, taking small “chunks” of profit out of the market.

The 1.65 level should offer support going forward, and as a result I would be willing to place a slightly larger than normal order at that point in the market if we get a supportive candle, especially a hammer which of course is my favorite formation.

The 1.63 level below there should also be supportive, but in the end I think it will take a lot to grind this pair down to that level. The area should continue to be the “absolute bottom”, and as long as we are above it – I see no real way to sell this market.