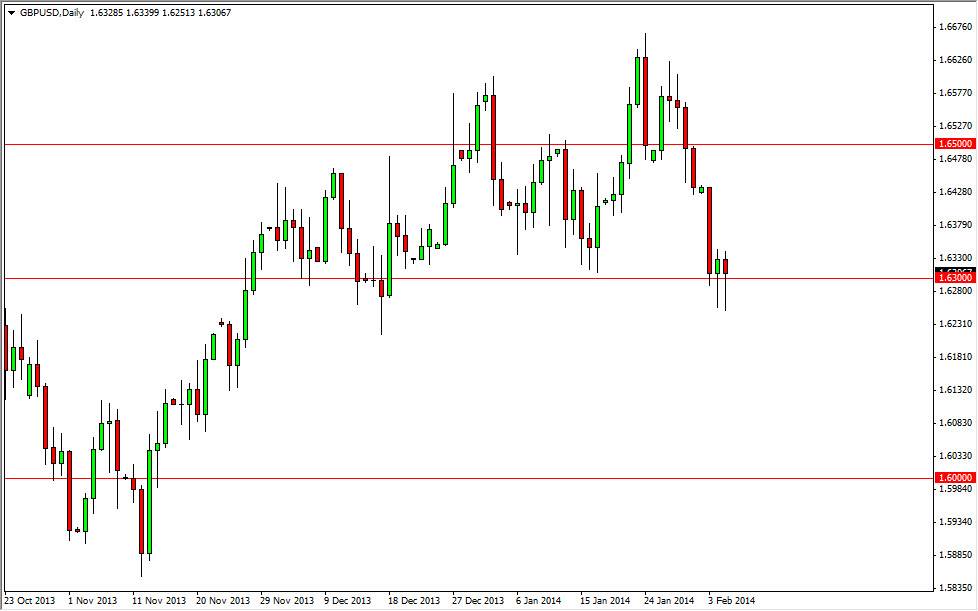

The GBP/USD pair fell hard during the session again on Wednesday, but for the second day in a row found enough support below the 1.63 level in order to form a nice-looking hammer. This hammer of course looks like it Is going to offer plenty of support, and with that we feel that the fact that the double hammers have formed suggests that the buyers are about to take control of this market yet again.

Because of this, we believe that a break of the top of the hammer from both the Tuesday and Wednesday session is more than enough of a reason to start buying, even if the very volatile nonfarm payroll numbers come out on Friday. In fact, in a lot of ways I believe this is a market that simply “tipping its hand” in order to show us what it’s about to do. A break higher should go to the 1.65 level, which of course is a large, round, psychologically significant number.

This is a “risk on” currency pair.

This pair is a risk on currency pair, meaning that it follows risk appetite in general. With that, you need to know what the world stock markets are doing in order to get a general feel as to how it should go. I believe that this market has Artie shown where was to go higher, and the fact that many of the stock markets around the world formed hammers as well during the session on Wednesday suggests to me that we are going to see a decent day or two ahead of the employment numbers.

Don’t forget though that the Federal Reserve and whether or not it can taper will depend greatly upon the employment numbers, so that has a massive of fact and influence on the US dollar. Obviously that’s half of the equation in this pair, but right now I see no real reason to short this market, and do believe that we are going higher. With that in mind, I have really no scenario is where I’m comfortable shorting this market at the moment.