After five consecutive days of gains, the XAUUSD pair (Gold vs. the American dollar) hit the highest level since November 11. The pair traded as high as 1293.70 after the bulls managed to push prices above the 1278 resistance level. Technically, this move was not surprising. As I repeated for the last three days, the 1278 resistance was the only hurdle blocking the bulls' advance towards 1293. Now the question is whether or not prices will continue to rise.

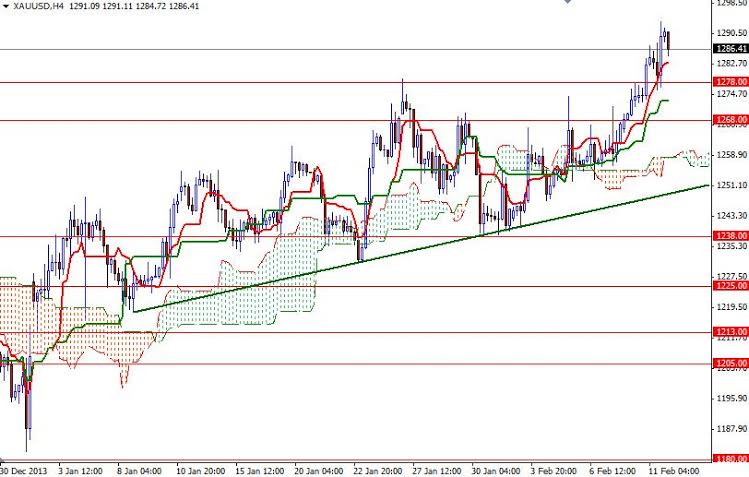

Looking at the charts from a purely technical point of view, the odds favor the bulls. The market is trading above the Ichimoku cloud on the daily and 4-hour charts. We also have bullish Tenkan-sen line (nine-period moving average, red line) - Kijun-sen line (twenty six-day moving average, green line) crosses on both time frames. If the bulls continue to dominate the pair and hold the pair above the Ichimoku clouds, it is likely that we will see the market testing the 1346 level eventually.

Since the XAU/USD pair has paused or reversed around that level several times in the past, I think it will be a very tough challenge for the bulls. However, in order to confirm this scenario, prices will have to break through the 1307 resistance level. If the bears successfully defend the 1293 barrier and increase selling pressure, we may see some profit taking and the pair testing the 1283 and 1278 support levels. Closing below the 1268 support level on a daily basis would suggest that the pair is heading back to the ascending trend line (4-hour chart).