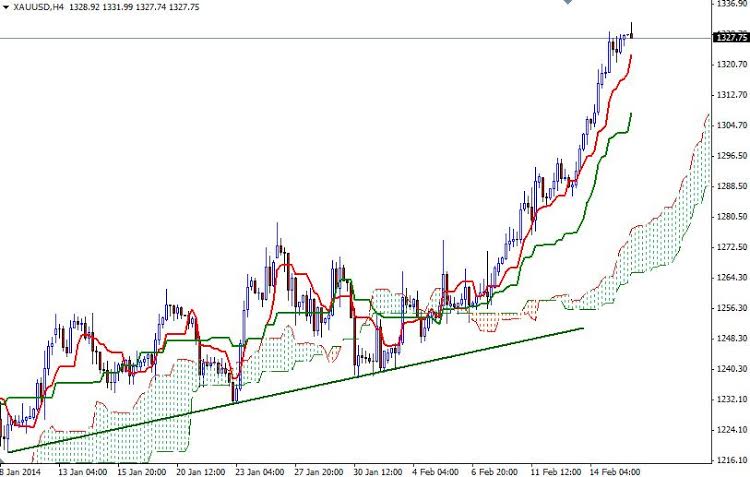

The XAU/USD pair (Gold vs. the American dollar) scored a gain of 0.76% yesterday as safe-haven demand continued to lure some investors back into the market. Gold traded as high as $1332 an ounce during today's Asian session but it seems that the bulls are running out of steam as market participants await the Bank of Japan's policy statement. Japanese hedge funds and banks are huge investors in gold and recent strength in Japanese yen (also volatile price action and sharp declines in Japanese equities) prompted a change in their investment portfolios.

The XAU/USD pair has been strongly bullish since the market broke through the 1268 resistance level but we are now approaching to the bottom of the Ichimoku cloud on the weekly time frame. Technically speaking, this area between 1376 and 1466 represents the strong resistances ahead of us. The thickness of the Ichimoku cloud is important because the thicker the cloud, the less likely it is that prices will manage a sustained break through it.

The thinner the Ichimoku cloud, a break through has a better chance. I believe the 1337 level is a strategic point for the bulls to conquer in order to advance towards the 1345 resistance level. If the bulls manage to hold prices above that level, it is likely that the pair will test the 1355 resistance level. In order to gain some strength, the bears will need to drag prices below yesterday's low. If that is the case, I can’t rule out a pull back towards the 1307 (or even possibly 1293) level before climbing higher.