Gold weakened against the American dollar for a second session on Wednesday after minutes from the Federal Reserve's January 28-29 policy meeting showed the central bank intends to continue the steady reduction in the pace of its asset purchases unless the economy deviates substantially from its expected path. The weak U.S. housing data continued yesterday but since this has already been factored in by the markets dull numbers didn’t have a long lasting impact on the dollar.

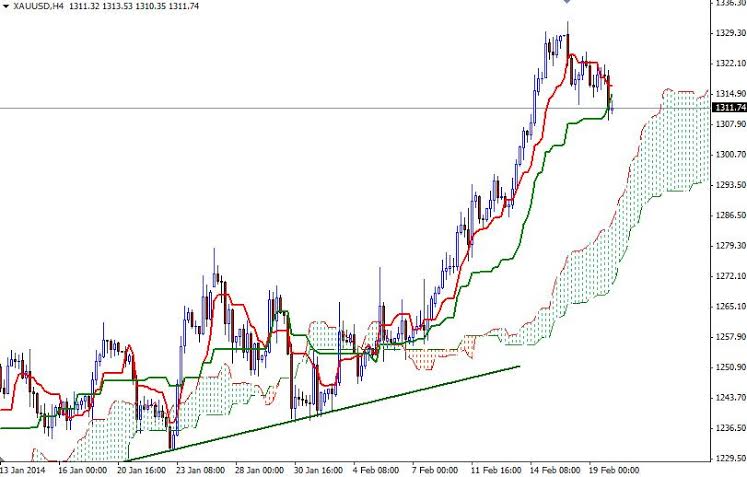

During the Asian session today the XAU/USD pair is trying to find some support around the 1307 level which happens to be a former resistance. If the market drops below that level, the pair may extend its losses and head towards the Tenkan-sen (nine-period moving average, red line) which currently sits at 1298. Below that the bulls will be waiting at 1293 and 1286. A slew of key economic indicators will be released today, including unemployment claims, consumer price index and Philadelphia Fed manufacturing index.

If the American dollar takes a hit from the upcoming fundamentals and we climb above the 1320 resistance level, the pair might continue its bullish tendencies and test the first strong barrier at 1337. Once the pair clears 1337, more resistance will be waiting at 1346 and 1355. In the meantime, I will continue monitoring the major stock markets and USD/JPY pair.