The XAU/USD pair rose for a third consecutive day as concerns over the world's largest economy continued to lure some investors to relative safety of the precious metal. Gold prices reached $1338.85 an ounce yesterday, the highest level in 16 weeks, before pulling back slightly to the 1335. According to data released by Markit, preliminary reading on the services sector fell to 52.7 from 56.7.

Separately, Federal Reserve Bank of Chicago reported that its national economic activity index fell to -0.39 in January from a revised -0.03 in December. Aside from weakening economic data from the United States, increasing physical demand helped providing lift to gold.

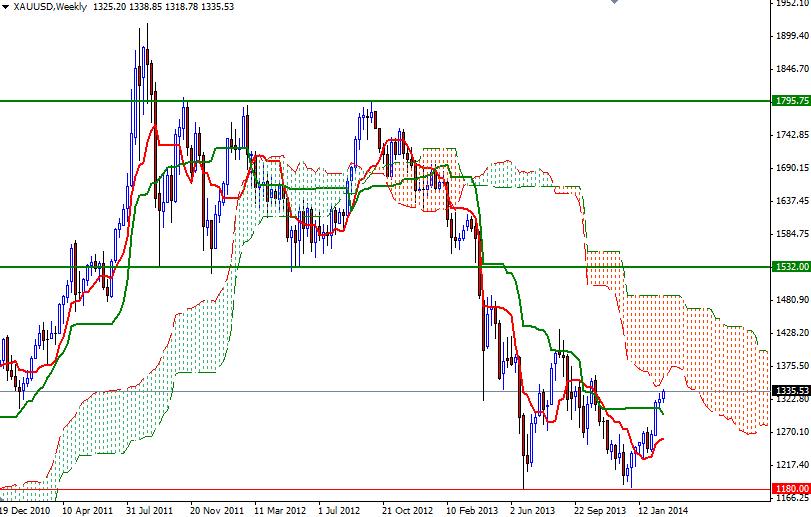

The XAU/USD pair has been rising steadily since we broke through the 1268 resistance level and left the Ichimoku clouds behind on the daily time frame but at this point I think buyers should take a cautious stance as prices approach the clouds on the weekly chart.

Currently the bottom of the cloud is located around the 1360 level so witnessing some extra resistance between 1360 and 1375 wouldn't be so surprising. In order to reach that zone the bulls will have to clear the first hurdle at 1337. If the bulls successfully push prices above 1337, there is a possibility that we can visit 1346 and 1355 soon after. However, if the bulls fail and the pair starts to retreat, support may be found at the 1328 and 1320/16 levels. Closing below the 1316 support on a daily basis would suggest that the pair is heading back to the 1307 level.