The XAU/USD pair closed yesterday's session lower than opening after four consecutive days of gains. Although the pair initially traded as high as $1345.31 an ounce, the precious metal lost some strength on technical selling and as better than expected U.S. housing data led to a bounce in the dollar. According to data released from the Commerce Department, sales of new homes rose 9.6% to an annualized pace of 468K units in January and December figures were up to 427K from 414K.

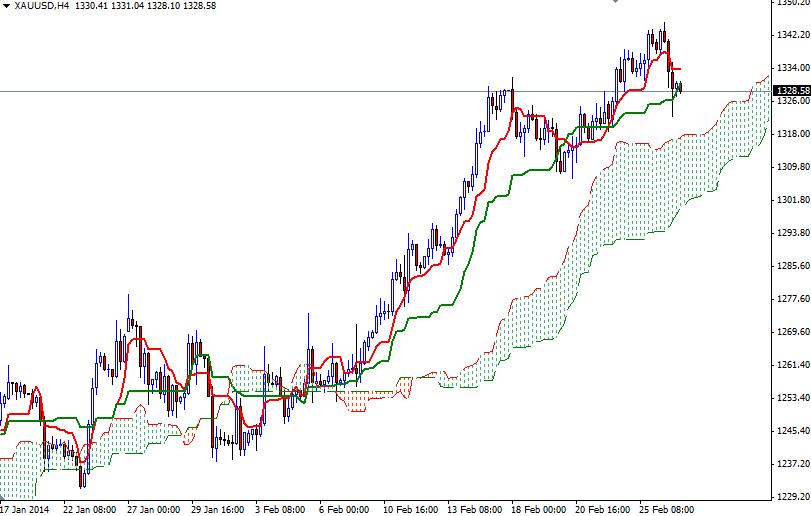

In my previous analysis, I had pointed out that the bullish momentum was fading and there was a divergence (disagreement) between RSI and price action on the 4 hour time frame. Yesterday's candle which engulfed the previous one makes me think that the market will continue to fall towards the Ichimoku clouds on the 4-hour chart, unless the bulls somehow push prices above the 1337 resistance level which also happens to be the Fibonacci 61.8 level (based on the bearish run from 1433.70 to 1182.35). If that happens, I expect to see some support between 1317 and 1306 levels which defines the borders of the cloud.

Breaking below the 1306 support on a daily basis might trigger a sell-off targeting the 1293 level. In order to regain their strength and take the reins, the bull will need to defend the 1317 support and break through the 1337 level. Only a sustained break above 1346 could give the bulls enough power to challenge the 1360 hurdle. Today the primary driver of gold prices today will be the headlines from the United States. Market participants await durable goods orders data and Federal Reserve Chair Janet Yellen’s testimony before the Senate Banking Committee.