Gold prices (XAU/USD) settled slightly higher after a slow session yesterday. The pair traded as low as 1323.73 but erased some of its recent loses as weaker than anticipated U.S. data eased the greenback’s safe-haven appeal. The Labor Department reported that the number of first-time applicants for jobless benefits increased 14K to 348K and data released by the Commerce Department revealed that orders for durable goods fell 1% in January.

Between growing perception that a pause in the Fed's reduction to its asset purchases remains on the table (if gloomy economic data persist) and mounting tension in Ukraine, gold will be appealing. However, the U.S. stock markets are running higher and this persistent rally might affect the precious metals performance. From a technical point of view, short-term and long-term charts are giving us mixed signals.

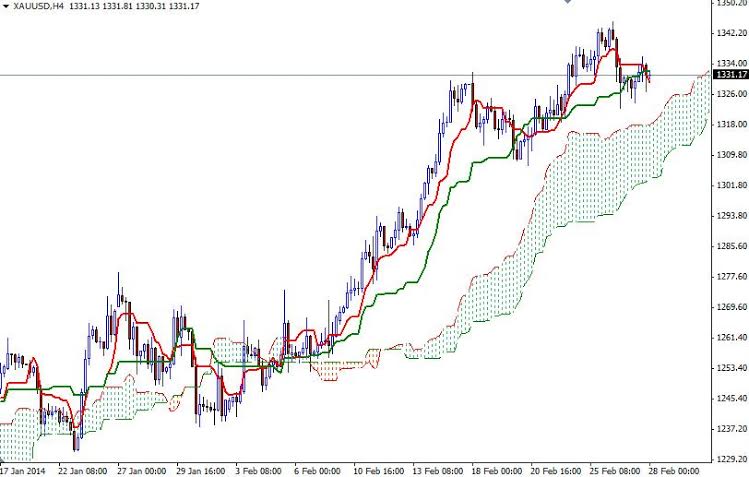

The 4-hour and daily charts are favoring the bulls at the moment but prices are still below the Ichimoku cloud on the weekly time frame. The first hurdle gold needs to jump is located around the 1337/8 levels. If prices break and manage to hold above the 1337/8 resistance, we could see the pair extending its gains and climbing towards the 1346 area. Above 1346, the real challenge will be waiting the bulls in the 1355 - 1360 zone.

To the down side, we might see some support around the 1323 - 1320 area. A break below 1320 would indicate that the bears won't give up before we revisit the 1307 support level. Today is heavy on the U.S. economic data (GDP, University of Michigan consumer sentiment and pending home sales) so expect some volatility.