Gold gave up some of its recent gains against the American dollar during yesterday's session on signs of stabilization in the risk environment. The shiny metal also lost some strength after both Chicago Fed President Charles Evans and Richmond Fed President Jeffrey Lacker backed further tapering of the central bank’s asset-buying program. Lacker said that the recent decline in equities hasn’t affected the outlook for labor market conditions materially at this point. He also noted “We linked the asset purchase programs to significant improvement in the outlook for labor market conditions. That has definitely occurred”.

Today the gold market remains steady during the Asian session as most investors are waiting for the ADP jobs report and ISM services PMI (today), ECB and BoE policy announcements (tomorrow) and non-farm payrolls figures (Friday). From a technical point of view, the candlesticks show a lack of momentum at the moment.

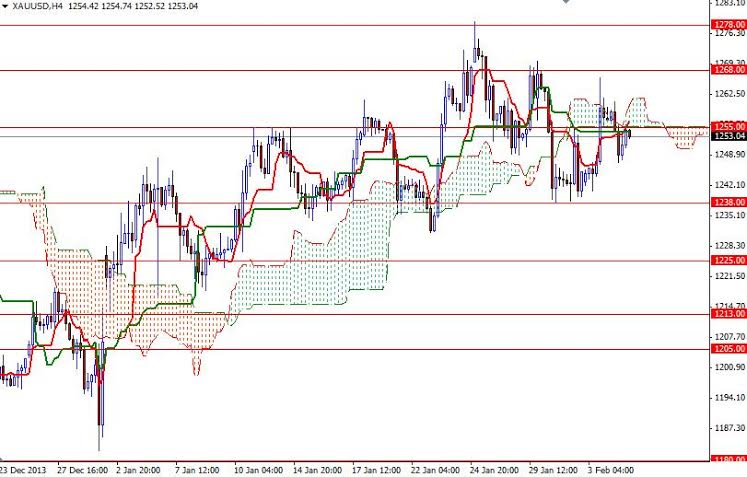

The XAU/USD pair is still moving inside the Ichimoku cloud on the daily chart, indicating that we will see prices consolidating some more time. Unless the bulls break through 1268, prices won't have much room to. That means the bulls have to break and hold above the 1268 level in order to gain enough strength to challenge the bears at 1293 area but before that 1274.48 - 1278 area will be the first hurdle. To the downside, there is an interim support at the 1246.60 level and the bears will have to pull prices below that level in order to march towards the 1238 support level. Closing below 1238 on a daily basis would indicate that 1230 may be tested soon after.