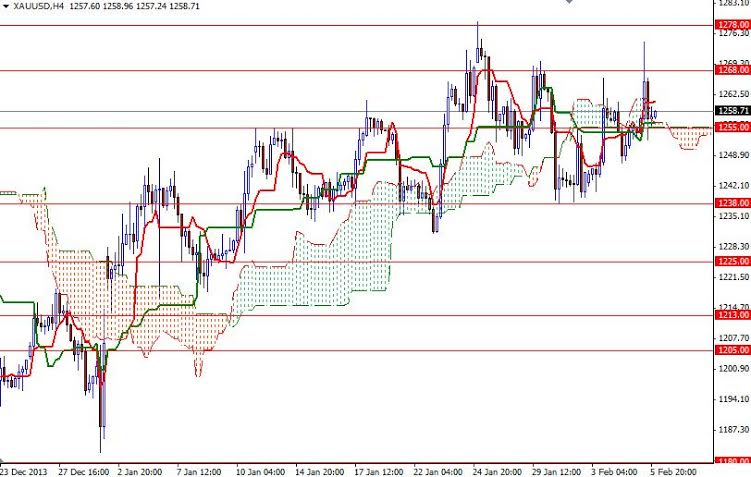

Gold prices (XAU/USD) settled slightly higher after a volatile session yesterday. The pair traded as high as 1274.40 after the ADP private jobs data fell short of market expectations but prices pulled all the way back to 1255 support level as sellers stepped in. Automatic Data Processing research institute said companies added 175K workers in January, less than expectations of 191K.

Yesterday, Institute for Supply Management reported that its non-manufacturing index climbed to 54 from 53 a month earlier. The XAU/USD pair has been range bound since we entered the Ichimoku cloud on the daily time frame and as you can see almost each candle has a long wick at one end. This indicates real uncertainty and as a result this pair can only be scalped in this zone in the near term. In the meantime, the market participants will be focusing on the ECB policy meeting and economic data out of the United States. Of course, price action in major stock markets will certainly be another thing to watch since the fear factor prompted a change in investment portfolios from equities into gold.

To the upside, resistance can be found at 1268, 1274.48 and 1278. In order to dominate the market, the bulls will have to push prices above the cloud on a daily basis at least. If the bears increase the downward pressure and drag the market below the 1245 support level, it is likely that we will see the pair testing the next support levels at 1238. Breaking this support would suggest that the 1230 level will be the next stop.