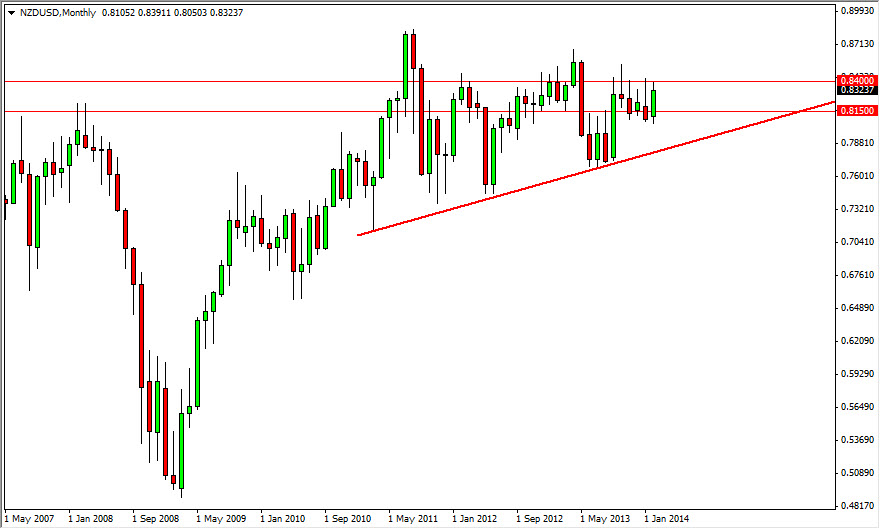

The NZD/USD pair as you can see has had a decent month in February. However, you can see that the previous four months were all shooting star shaped candles. This tells me that there is a significant amount of resistance above, probably extending from the 0.84 level, up to the 0.85 handle. And that is exactly what I’m paying attention to - 0.85, and whether or not the market can finally break above it.

If we do, I believe that the New Zealand dollar should continue to strengthen for some time. The biggest problem with the New Zealand dollar is that it’s a highly leverage to commodities, which are a mixed bag at the moment. Nonetheless, then attention to the overall attitude of the commodity markets will probably be crucial for the New Zealand dollar as per usual, and the better that the commodity markets “feel”, the better the New Zealand dollar will do.

Pay attention to the Federal Reserve as well.

Part of the reason that the New Zealand dollar cannot find any real traction probably has to do with the Federal Reserve and the fact that they are tapering off of quantitative easing. That has strengthened the US dollar in general, and a somewhat illiquid Pacific commodity currency is going to get hit when the world’s reserve currency services strengthen. However, looking at this chart you can see that I have a long-term uptrend line in place. It doesn’t look that impressive when you first glance at it, except for the fact that the hammer that I have started it at was actually all the way back at the end of 2010. With that being said, this is a fairly significant trend line.

I recognize that we are nowhere near that support, but truthfully I think it shows the general attitude of the market, which is for the New Zealand dollar to go higher albeit slowly. I a.m. not going to risk my trading capital at this level, but I do believe that a post 0.85 level printing on a daily close is probably enough to start buying the Kiwi dollar yet again. The other scenario of course would be if we get a pullback to that uptrend line, and some type of supportive candle.