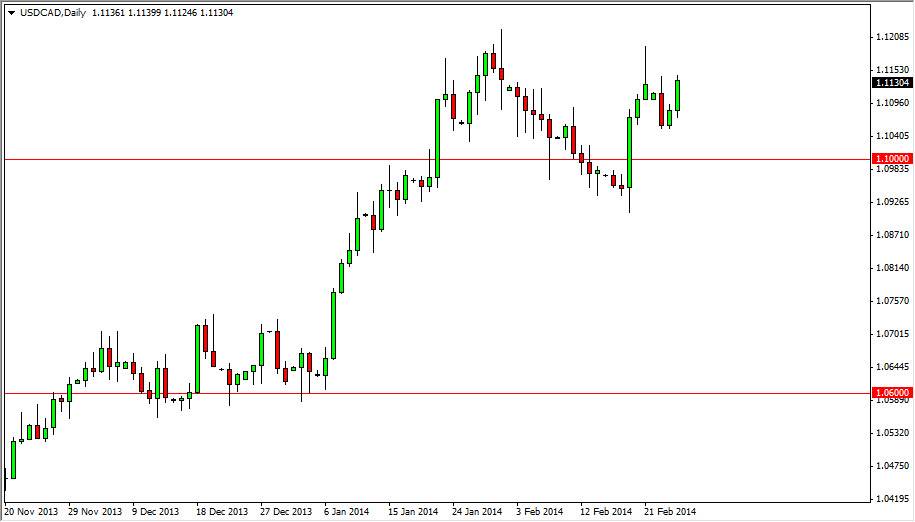

The USD/CAD pair had a strong showing on Wednesday, as the uptrend looks set to continue finally. The recent pullback was needed though, and as a result I think that the buyers are going to start stepping in again. The 1.12 level will continue to offer resistance going forward, but in the end I feel that this pair goes higher. After all, we have seen strong moves in the oil markets to the upside, while the Loonie has struggled. This tells me that this pair is moving based upon the interest rate outlook, and not the usual oil correlation with the Canadian dollar.

This market seems to be consolidating still though, as the area has seen a bit of choppiness recently. In this scenario, it is likely that the market will continue to be choppy overall, but once we clear the 1.12 level – I think this pair could very well take off to the upside. In fact, at this point in time I would be looking for a move to the 1.15 level.

Pullbacks should be buying opportunities.

The pullbacks that will happen in this market will be buying opportunities in my opinion. In fact, I would welcome short-term pullbacks on the lower time frames in order to capitalize on value. This market really isn’t broken to the downside in my opinion until we get below the 1.0850 level on a daily close. This isn’t something I would expect anytime soon, so in essence I am “buy only.”

The oil markets could come back into play, but at this point in time I don’t really see that this market is paying attention. As long as the Federal Reserve is looking to continue the tapering off of quantitative easing that has recently put a bid in the US dollar against most currencies. The markets will more than likely grind in the meantime, which is very normal for this pair. We will see a grind, and then an impulsive move. I believe this is because the two economies are so interconnected. Because of this, if you enter the market, patience will often be needed.