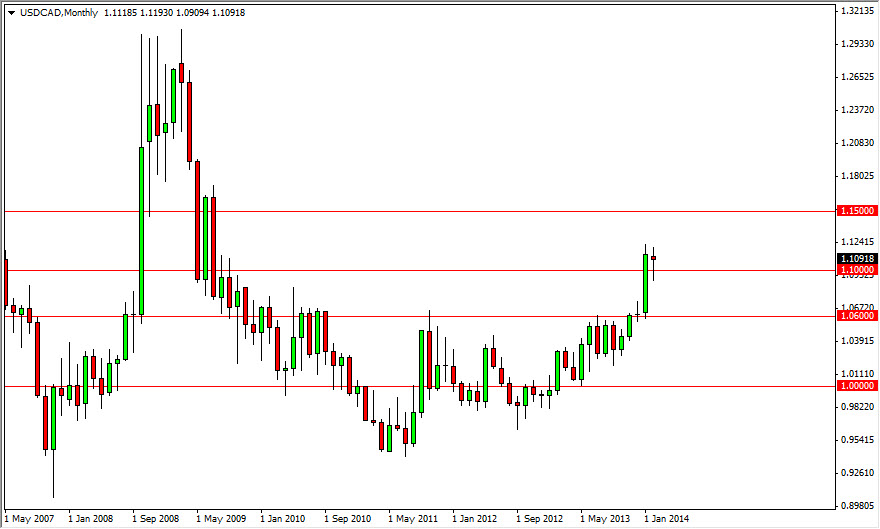

The USD/CAD pair is a market that I’ve been very interested in since we broke above the 1.06 level. The fact that we broke above that area signified to me that this market was going to go much higher. What I was not anticipating was that the month of January was going to be so explosive to the upside. Sure, I believe that we were going to go higher, but I didn’t think we were going to break through all of that resistance in such a short amount of time.

Attached to this article is the monthly USD/CAD chart, and as you can see we are forming a hammer for the monthly candle representing February. The fact that this hammer sits right on the 1.10 level suggests to me that we are going higher again, and as you can see I have the 1.15 level drawn as a potential resistance area. Quite frankly, the only reason I have that area marked is that it is such a large, round, psychologically significant number. Honestly, I don’t really see too much in the way of resistance at that particular level, and quite frankly believe that the 1.16 level is probably more resistant. Nonetheless, it makes sense to pay attention to these big numbers.

Pullbacks should offer buying opportunities going forward.

Pullbacks going forward should be buying opportunities as far as I can tell, as monthly hammers are indeed very good signs for the buyers. After all, it takes quite a bit of information in order to form a monthly candle, and the fact that we have a hammer at such an obvious former resistance area leads me to believe that we have now retested that resistance in order to prove it as support. I don’t know that we will get to the 1.15 level during the month of March, but I think we are heading in that direction. I have no interest in selling this pair, and quite frankly believe that even if we broke down from here, 1.06 would keep the market afloat. I am very bullish of this pair based upon this technical set up, and the fact that even with higher oil prices, the Canadian dollar cannot strengthen.