By: John Ursus

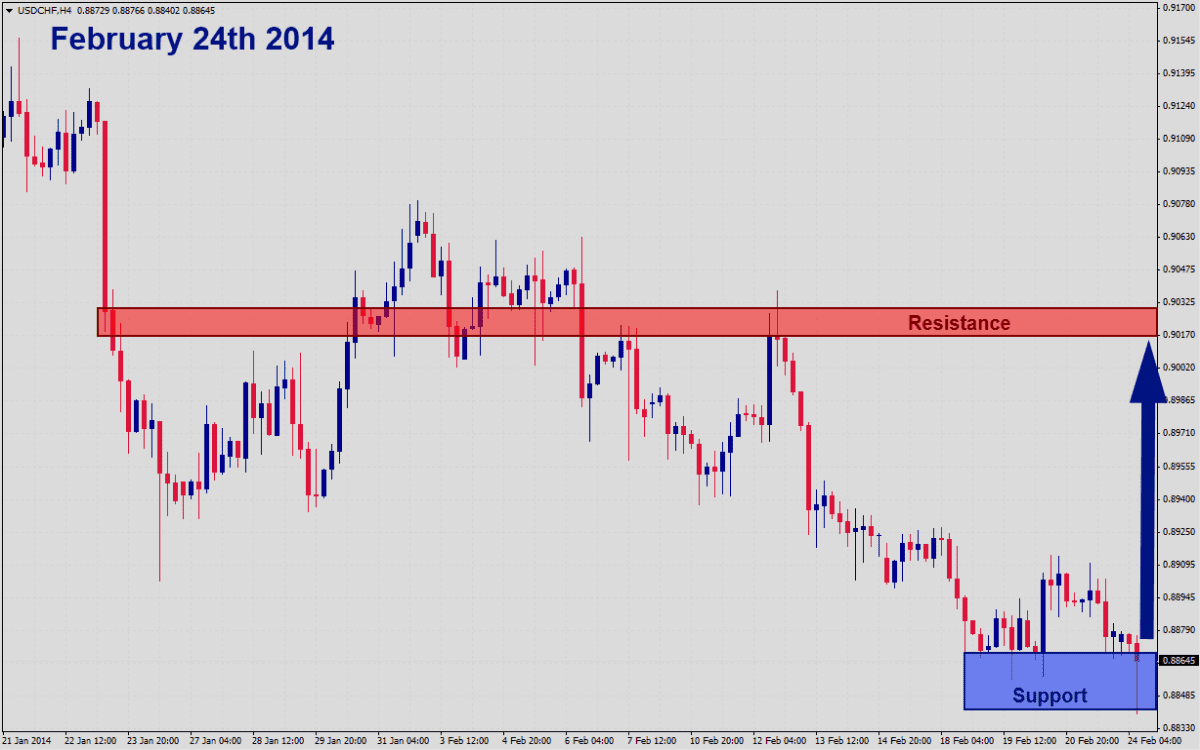

Timeframe: H4

Recommendation: Long Position

Entry Level: Short Position @ 0.8860

Take Profit Zone: 0.9020 – 0.9050

Stop Loss Level: 0.8785

The USDCHF has corrected sharply after briefly trading above its current resistance are. The bearish moves in this currency pair may be nearing an end and forex traders could see a reversal rally which may be fueled by short-covering as traders seek to lock in trading profits. The US Dollar has deteriorated sharply as economic disappointments have resulted in a prolonged sell-off which was only temporarily interrupted after the US Federal Reserve started to taper its economic stimulus plan.

Forex traders may seek to lock in profits before next week’s non-farm payroll report out of the US which will likely to move this currency pair. The current sell-off should be interrupted inside its current support area and as the last candlestick has formed a hammer formation inside this zone which is a very bullish sign and suggests that forex traders may be looking into a minor reversal rally from current levels.

Should next week’s non-farm payroll report out of the US disappoint for a third consecutive months the US Dollar should sell-off sharply and forex traders should exit this long position. In case the non-farm payroll report will come in as expected or slightly higher the USDCHF should approach its take profit target rather fast. Forex traders should be prepared for another spike in volatility on high volume next week and take this into consideration before entering this trade.