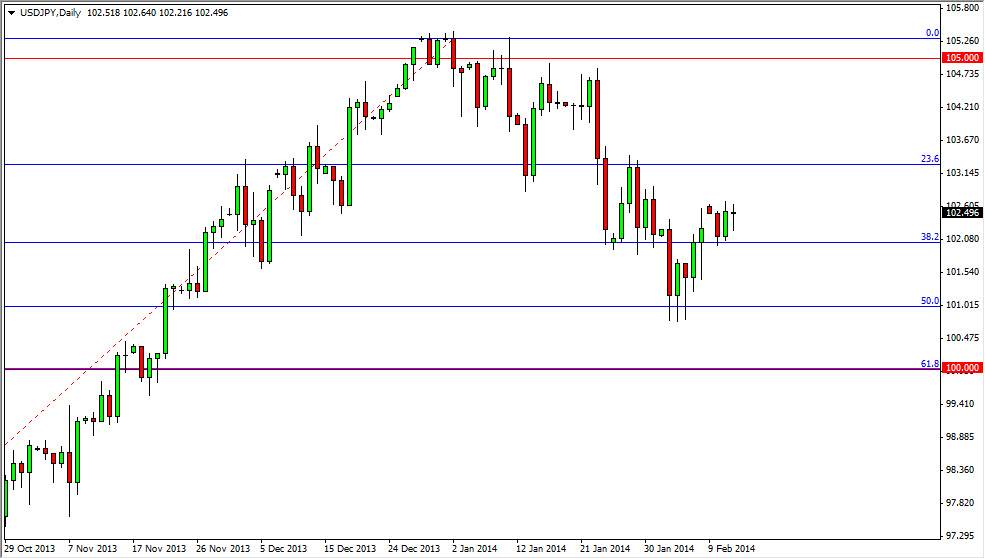

The USD/JPY pair initially fell during the session on Wednesday, but as you can see found enough support above the 102 level to bounce and form a hammer. This hammer of course jibes well with my overall bullish outlook in this market, and as a result I am encouraged by the session’s action. On a break above the top of the hammer, I believe that buying this pair is possible again, and full disclosure: I have been buying little bits and pieces of this market for some time now. In fact, I am very short of the Japanese yen against a multitude of currencies, not just the US dollar.

Unfortunately, this pair doesn’t pay any swap, but a lot of the yen related pairs do. Because of this, I have several different positions on, but the core fact is I am short of the Japanese yen, mainly because the central bank in Tokyo looks set to continue to work against the value of the currency.

Divergent central banks.

With the Federal Reserve recently announcing that it was going to continue tapering, and the Bank of Japan is obviously with a very easy monetary policy, this should be a “one-way trade.” Probably not going to be quite that simple, but over the longer term I believe that we will look at these last few months as the bottom of this market. This has happened before, so quite frankly it’s not really that big of a surprise.

Ultimately, I believe that by adding small positions on occasionally, this will end up being a massive position in my portfolio, and think of this more or less as an investment than any type of trade. Because of this, I do have a little bit different of an Outlook on this market then I do others, simply because when it pulls back, I start to think of it as being a value play and not some type of concern. Occasionally, I will buy options to protect my position a little bit, but at the end of the day I am always going to be long of this market.