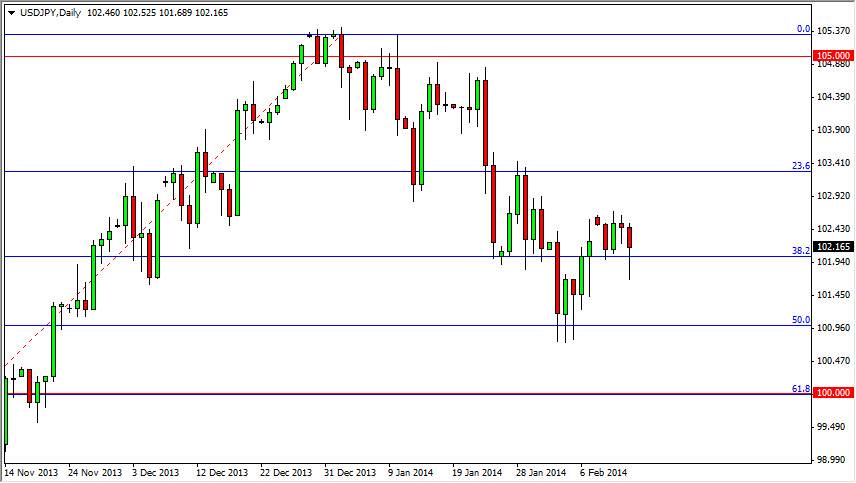

The USD/JPY pair fell during the session on Thursday, but bounced hard enough to form a hammer by the end of the day. The market seems to be finding a lot of support at the 102 level, and this level continues to be one of interest for me. The market is a long-term play in my portfolio, and I plan on being short of the Yen for the foreseeable future, although the pair has pulled back lately. This being the case, there will continue to be pull backs that the market will throw at us. However, my strategy has been to add slowly to my position – with the key word being SLOWLY.

This position is a long-term one for me, one that I think I will be in for months, if not years. Eventually, the interest rate differential will continue to expand between the two currencies as the central banks are on totally different paths.

Central banks

The central banks involved are setting up a great trade long-term in my opinion. The Federal Reserve is tapering at the moment, and Janet Yellen has recently stated that the Fed is ready to continue to taper as the economy is strong enough. This should naturally favor higher interest rates as the bond market will continue to sell off.

The Bank of Japan is looking to expand monetary policy, and this will continue to work against the value of the Yen overall. The interest rates for bonds should continue to drop, therefore making the market less attractive, and in turn making the Yen in less demand. In this situation, it makes more sense for money to flow from Japan to the United States, not the other way around. With that, the flow of money should continue to be in my favor.

In the end, the longer-term outlook allows for pullbacks to represent value. I am buying yet again at the top of the hammer for the session, and at large round numbers. This should continue to be the case until 105, and probably 110.