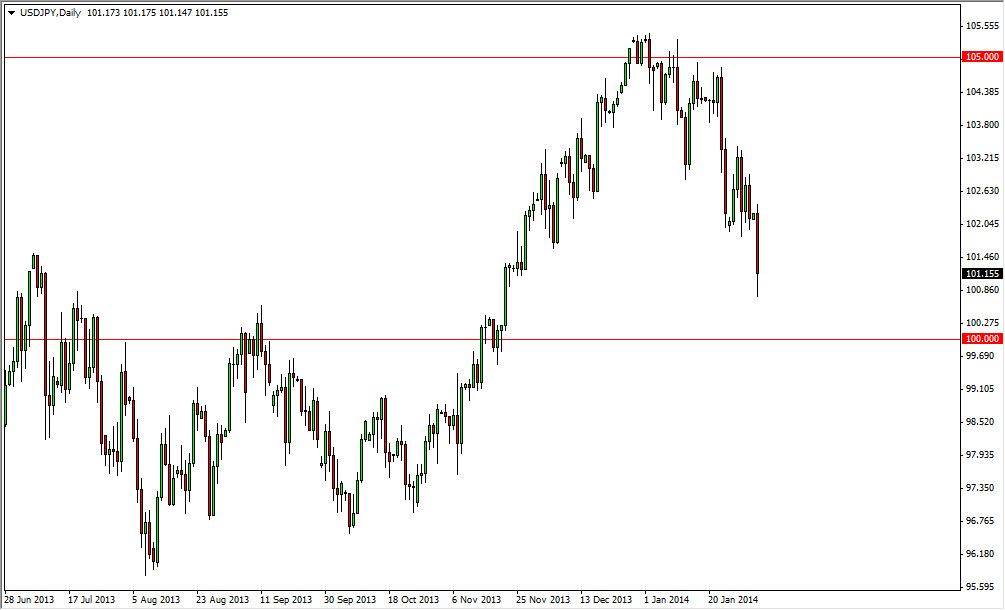

The USD/JPY pair fell hard during the session on Monday, as the ISM numbers came out much weaker than anticipated. Because of this, people are starting to question whether not the Federal Reserve will continue to taper, or at least be able to and this of course has a massive effect on this market. With the jobs numbers coming out on Friday though, one has to wonder whether or not this is just a matter of people getting out of this pair and finding the first excuse to do it. After all, the USD/JPY pair tends to be very sensitive to the nonfarm payroll numbers, and with that I suspect that the real move will come on Friday.

The 100 level below should be massively supportive, and with that I believe that buying a supportive candle down there that area is probably the way to go. Obviously we don’t have that yet, but looking at the candle for the Monday session would not surprise me at all if we drift down to that level over the course of the next couple of days. After all, we stayed close to the bottom of the range for the session, which of course is always a very bearish sign.

Patience.

It’s going to take a certain amount of patience between now and Friday, but I believe that eventually we will get our signal. I still believe that this pair goes higher over the longer term, simply because the Bank of Japan is so active in trying to keep the value of the Yen down. If this pair falls too much farther, you can pretty much count on the Bank of Japan stepping in either verbally, or possibly even with some type of monetary policy. They have shown more than once that there willing to do it, and quite frankly I have a hard time believing that the Federal Reserve cares about the value of the Yen overall. With that, I believe that I will be buying this pair soon, but need to see a supportive daily candle in order to get involved.