USD/JPY Signal Update

Last Thursday’s signals were not triggered and expired.

Today’s USD/JPY Signal

Long Trade 1

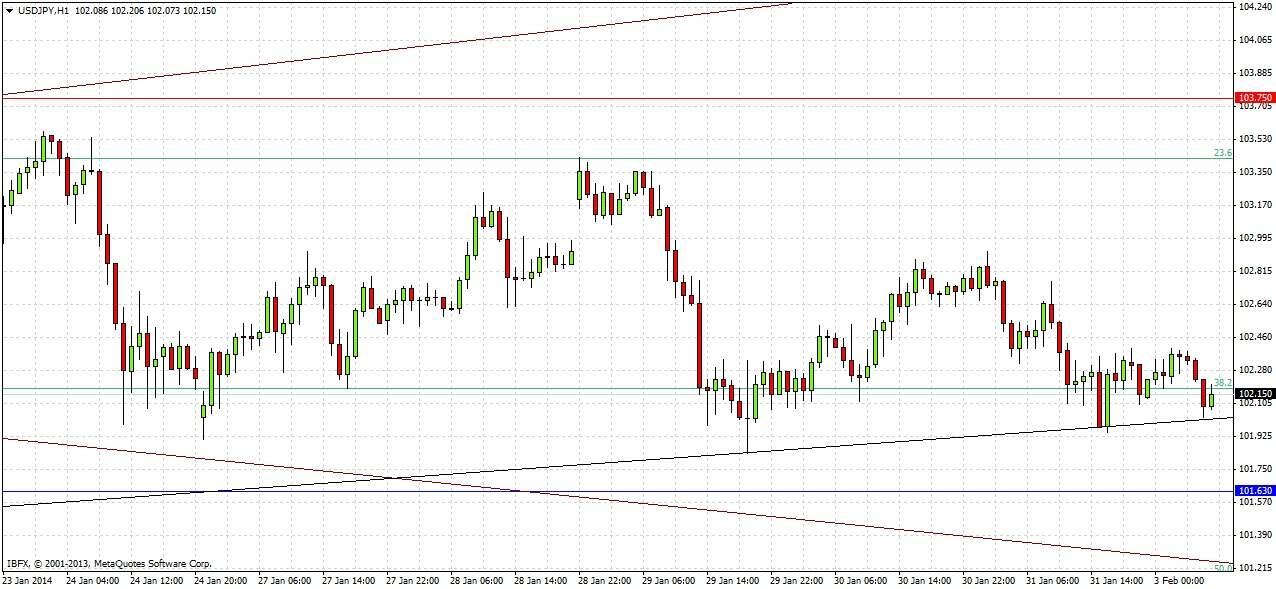

Enter long if a pin or engulfing bar is formed on the hourly chart when the price first reaches 101.63, on the break of the bar by 1 pip on the next bar. If a bar closes below 101.60, the trade is invalidated.

Stop loss at the local swing low.

Move the stop loss to break even when the trade is 25 pips in profit. Take 50% of the position as profit at 102.70 and leave the remainder of the position to run to 103.75.

Risk 0.50% and the trade may be taken until 8am London time tomorrow.

Short Trade 1

Enter short if a pin or engulfing bar is formed on the hourly chart when the price first reaches 103.75, on the break of the bar by 1 pip on the next bar. If a bar closes above 103.75, the trade is invalidated.

Stop loss at the local swing high.

Move the stop loss to break even when the trade is 25 pips in profit. Take 50% of the position as profit at 103.05 and leave the remainder of the position to run.

Risk 0.50% and the trade may be taken until 8am London time tomorrow.

USD/JPY Analysis

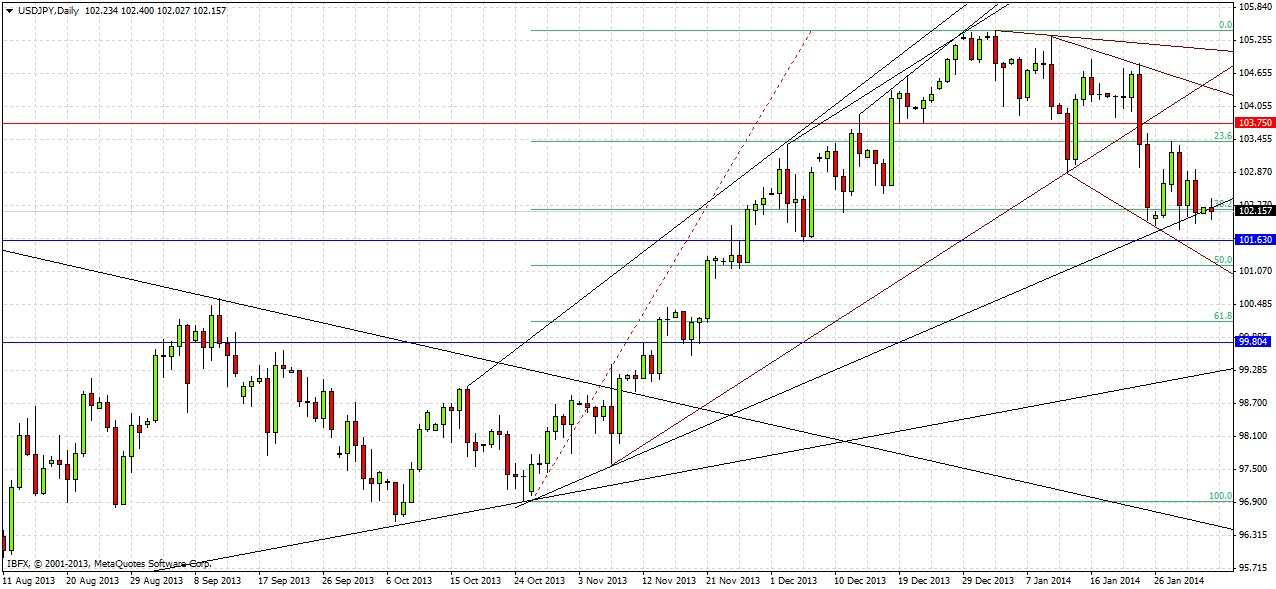

Following the recent multi-month uptrend, we are now established within a bearish channel, although we are also sitting on a very long-term bullish trend line, as can be seen in the daily chart below:

Although the overall picture seems bearish with the strong downwards move and the anti-risk fearful market sentiment that has led to a strengthening of the JPY across the board, I am looking for both long and short trades.

Friday printed a bearish engulfing outside bar, suggesting there will be a further move down today if we break 101.93. Nevertheless I expect there to be support at 101.63. Below that at 101.20 is the 50% Fibonacci retrace of the post-October upwards move. Above us is likely support turned to resistance at around 103.75:

There is no important news due today for the JPY. Concerning the USD, there is at news at 3pm London time (ISM Manufacturing PMI).