We publish Adam’s trading signals daily covering EUR/USD, GBP/USD, and USD/JPY. As they are daily signals which are not updated throughout the day, they are conservative, and as such are frequently not triggered. Adam gives either exact prices at which trades should be taken, or trades which should be taken if confirmed by price action at certain prices.

During the month of January, only one of the signals was triggered: a USD/JPY trade, which broke even. Therefore following Adam’s free Forex signals since December 2013 was profitable overall, as his signals in December 2013 were profitable.

Let’s review the signal that was triggered.

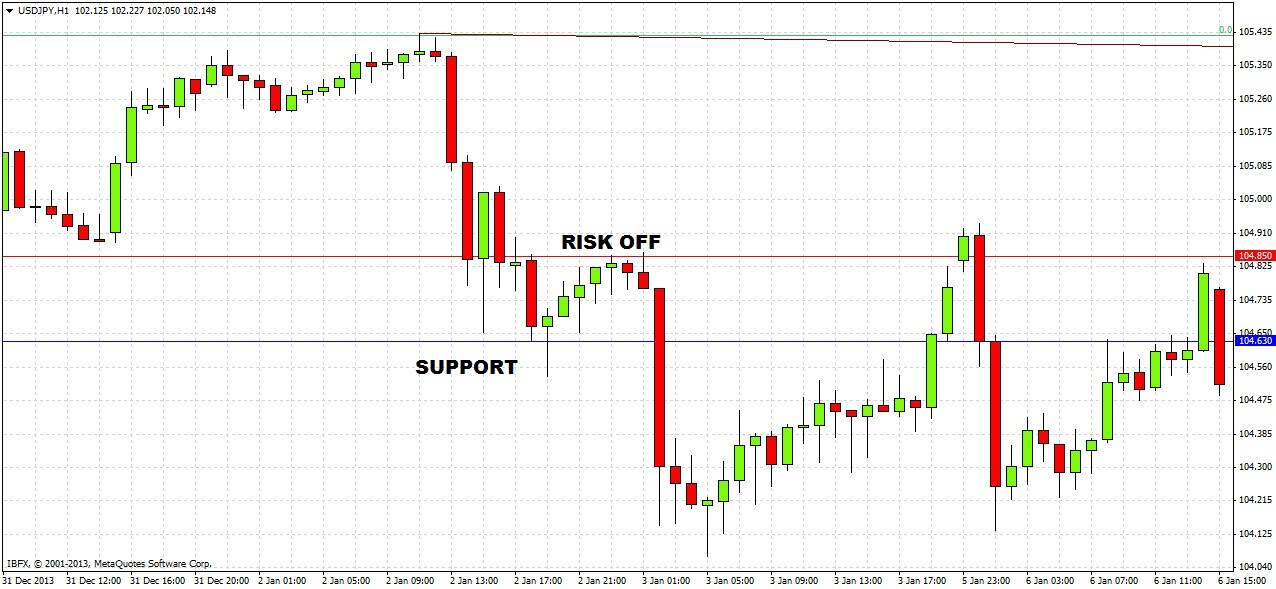

Signal 1 – USD/JPY 2nd January 2013

The signal was published at 08:04 GMT. It was given as:

Long Trade

Enter long at the next bar break of an hourly pin or strong outside or engulfing bar rejecting and closing above 104.63. If this levels is not touched and rejected by the same hourly bar, or if an hourly bar closes more than a few pips below 104.63, the trade is immediately invalidated and should not be taken.

Stop loss at the local swing low or 104.48, depending upon how close the entry is to 104.63. If the entry is very close, then the lower of the two should definitely be used.

Take the risk off the position at 104.85, move the stop loss to break even if possible. Let the remainder of the position ride.

As can be seen from the hourly chart below, a pin bar rejecting 104.63 closed at 20:00 GMT, giving an entry at 104.73 with a stop loss at 104.48. The initial target of 1.6388 was hit during the hour following 23:00, at which point the risk should have been taken off the trade, but it was really too early to do so by moving the stop loss to break even. The stop loss was hit between 02:00 and 03:00 GMT the next day.

The trade broke even.

Total Monthly Profit/Loss

The month broke even, with no profit or loss.

There were no losing trades.