USD/JPY

The USD/JPY pair spent most of the week falling, but as you can see bounced off of the 50% Fibonacci retracement level in order to form a hammer. The hammer comes just after a shooting star from the previous week, so it suggests that we may have a little bit of a fight on her hands going higher, but most certainly we are in an uptrend, and that has not changed. With that, I believe that a break above the highs from the hammer is the market telling us that it was to go back to the 105 level, and then eventually higher than that. Ultimately, I still expect to see the 110 level tested.

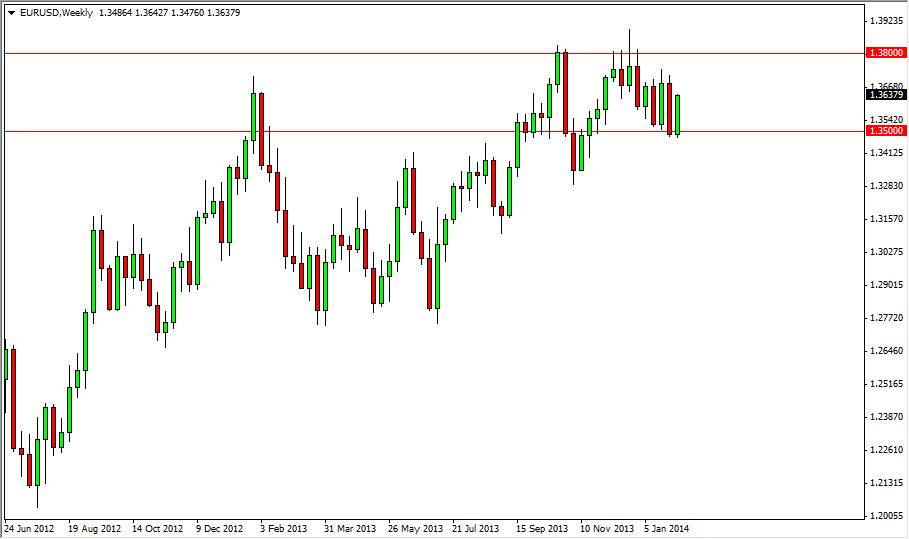

EUR/USD

The EUR/USD pair had a positive week, using the 1.35 level as a springboard to go higher. Looking at this chart, it is obvious to me that we are in a fairly consolidated type of mood, and as a result I think that the 1.38 level will continue to offer enough resistance to keep the market down. From a long-term standpoint, I don’t really see much in this chart that were being bothered with. However, I will of course keep an eye on it.

USD/CAD

The USD/CAD pair as you can see spent most of the week falling, but found the 1.10 level supportive enough to turn the market back around and bounce. The bounce formed is something along the lines of a hammer, but what I find most interesting is that even after the shooting star for the previous week, the losses were relatively minor and the 1.10 level did in fact offer that support in order to keep the uptrend going. Because of this, I believe that the market will eventually go higher, but we may see a bit of choppiness in the short-term. I still think the 1.15 level is the target in this market eventually. With that, I am looking for shorter-term signals to start buying in a market that longer-term should go higher. Interestingly enough, the Friday candle is in fact a hammer.

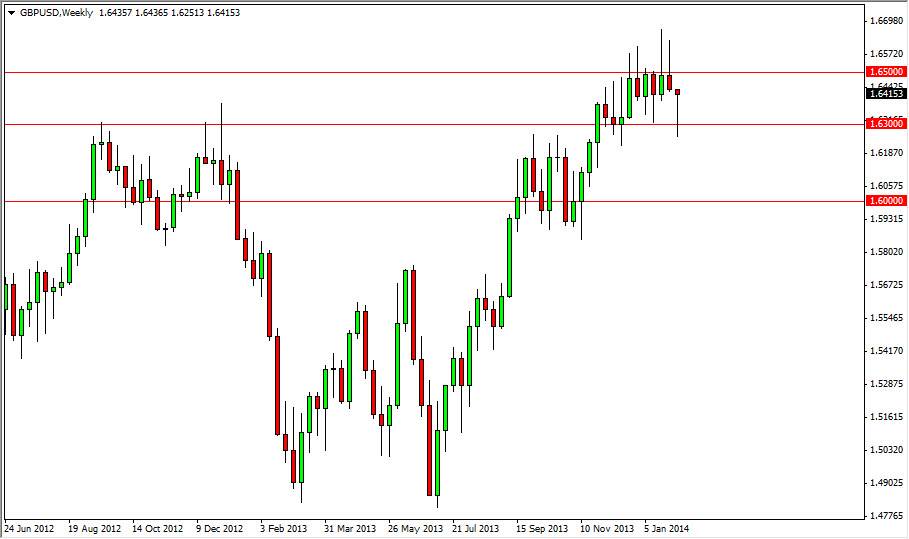

GBP/USD

The GBP USD pair fell during the bulk of the week as well, finding support at the 1.63 area. This is an area that has been supportive lately, and the bottom of the consolidation area that we have been stuck in. This isn’t much of a surprise really, but it does reinforce the fact that I think that this market is going to go sideways overall. The last six weeks have featured three hammers, and three shooting stars. That there was ever a sign of confusion, that’s it. However, I do believe that ultimately this pair goes higher as the trend is most certainly to the upside.