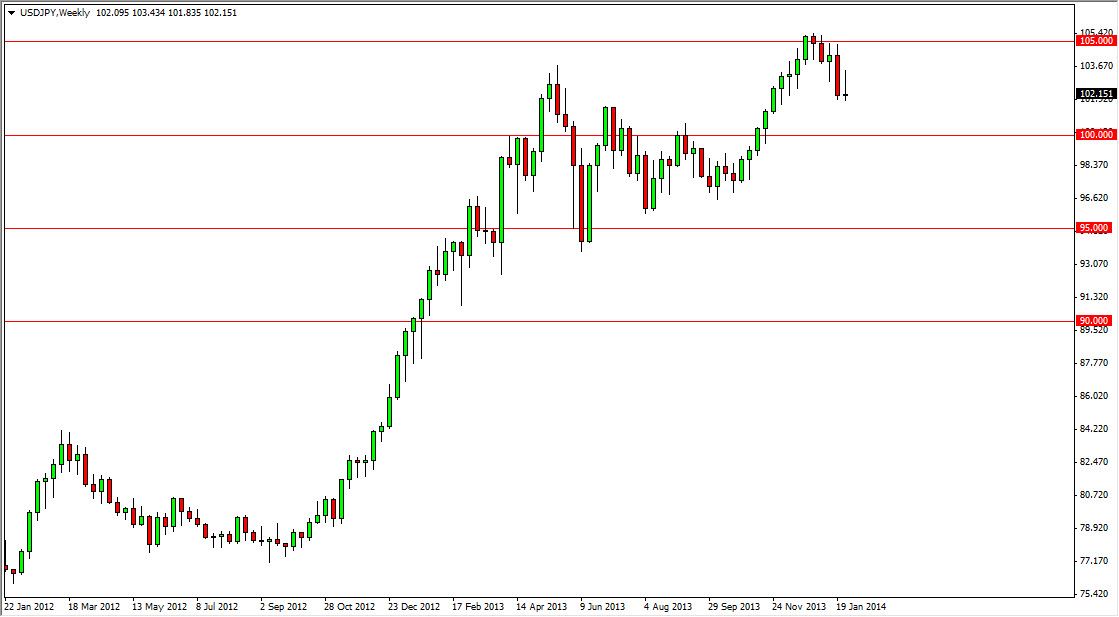

USD/JPY

The USD/JPY pair has been bullish for some time now, but the last two weeks haven’t been as per usual. The attempted rally over the last week and subsequent failure has shown me that the market is probably looking to fall from here. The shape of the shooting star is just about perfect, so I think this pair will more than likely head back down towards the 100 level, where it will find significant support. I am still bullish longer-term, and believe this Friday’s Non-Farm report will be crucial. The better the number, the higher this pair bounces.

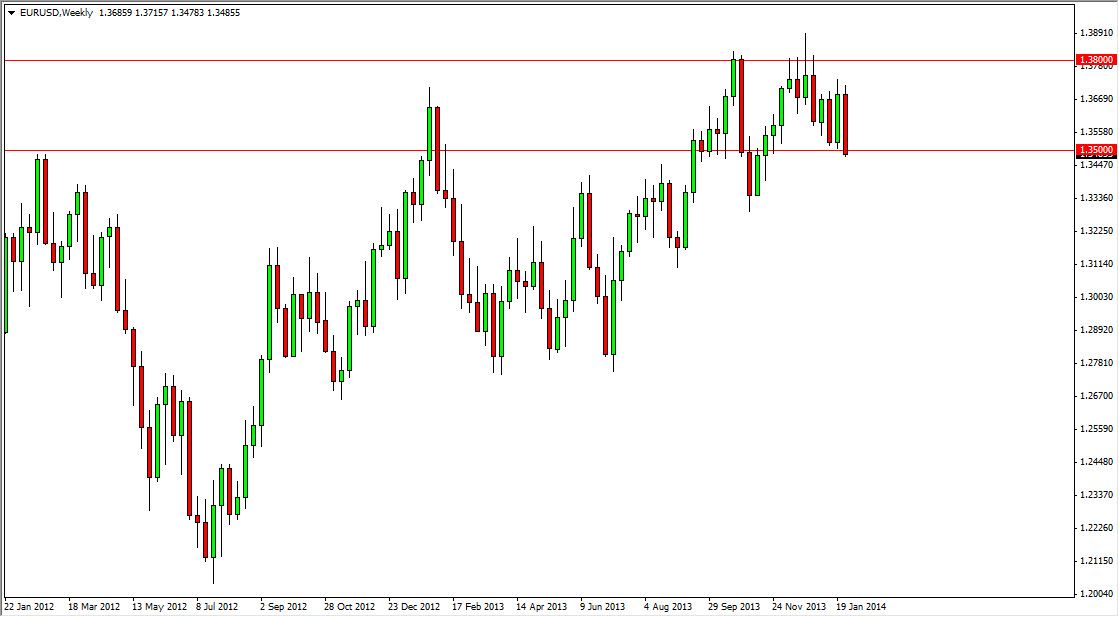

EUR/USD

The EUR/USD pair fell over the course of the week, and even managed to close below the 1.35 level. However, we haven’t cleared the support level just yet, but a move lower from here has the Euro looking for the 1.33 level in my opinion. The ECB has an interest rate decision this week, and the Non-Farm payroll number will also have the market guessing as to what the Federal Reserve does next. If there is a week where this pair could break down – this would be it.

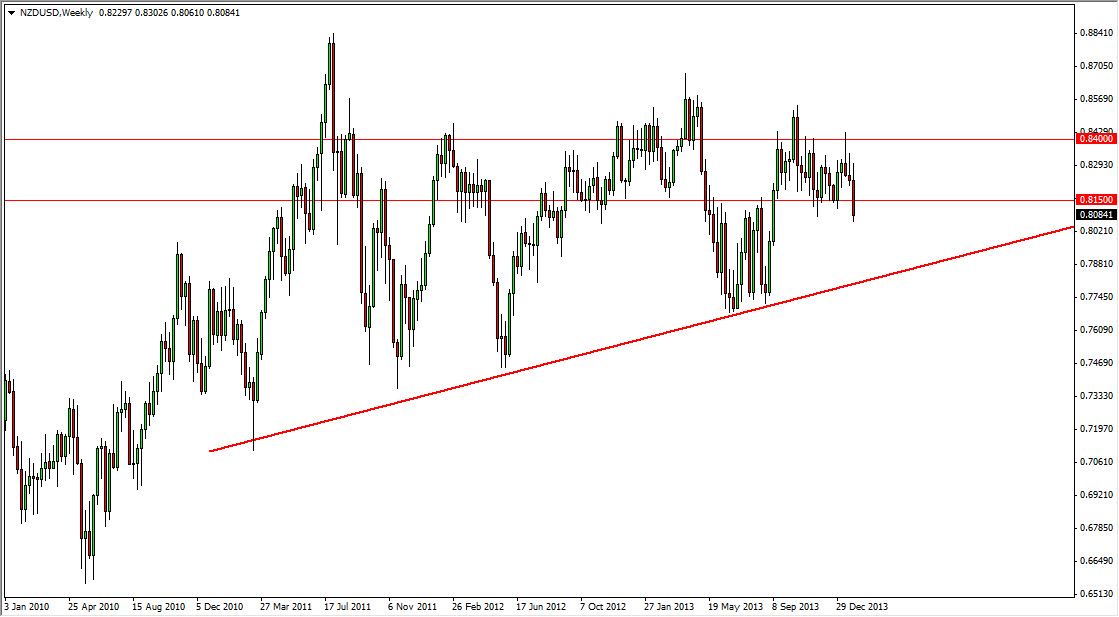

NZD/USD

The NZD/USD pair finally broke through the 0.8150 level, but still faces a significant uptrend line from the monthly chart a couple of hundred pips below. It is because of this that I think the NZD will fall for the next week or two, but after that will find buyers. The market have been respecting the uptrend line so far, and there isn’t much out there – apart from a surprise out of the Fed – that I think will move this market below that trend line. Because of this – I am short-term bearish, but longer-term slightly bullish as the move higher will be a grind, not a straight shot.

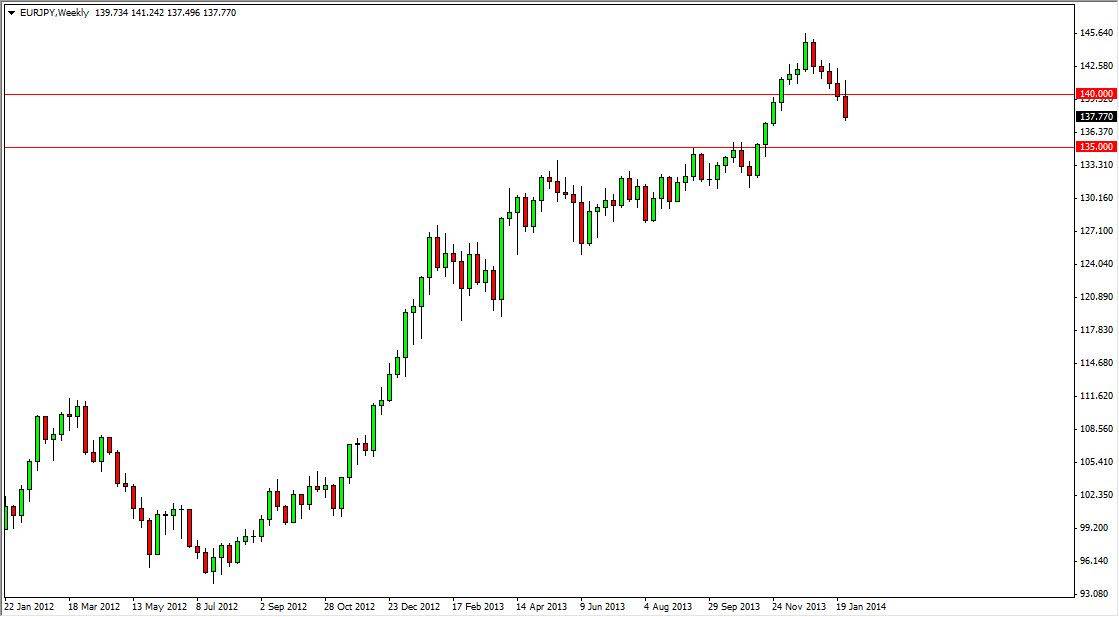

EUR/JPY

The EUR/JPY pair tried to rise above the 140 level, but found the area far too resistive to stay above for any real length of time. This area was resistive enough to push the markets much lower, and as a result the candle looks very weak. The next support level that I see is the clearly defined 135 handle, and I think that is where we are heading quite frankly. Long-term, I am still bullish though, and I think that area is going to offer an excellent entry level into the long side of this pair.