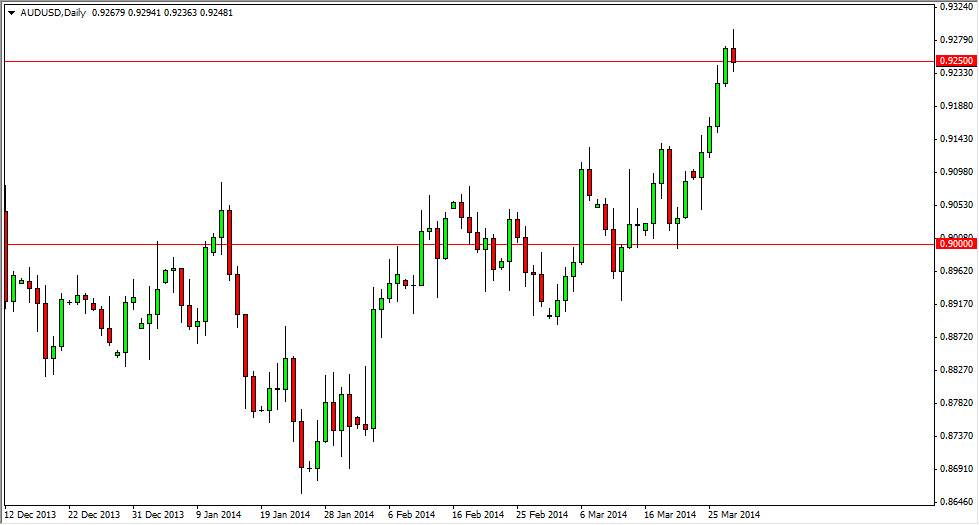

The AUD/USD pair initially rallied during the session on Friday, but as you can see pulled back in order to form a shooting star. I find this particularly interesting because we are sitting right on top of the 0.9250 level, an area that I anticipated been rather resistive. Because of the shape of the candle, I believe that we are about to see some type of pullback, but would also recognize that the 0.91 level will be rather supportive. So really comes down to which type of trader you are as to which type of trade you want to take in this pair.

The one thing that would be a common theme for both the short and long-term trader would be if we managed to break the top of the shooting star. If we do, we had to the 0.95 level given enough time in my opinion. That of course would show a breaking of significant resistance.

Depending on your timeframe, the trade is going to be different.

If you are short-term trader, selling a break of the bottom of the shooting star is a perfectly viable opportunity, as it is a resistance area and there does seem to be a bit of a pocket of “air” between here and the 0.91 level. However, if you are more of a swing trader like I am, you’re probably going to be more comfortable buying a supportive candle down near that same 0.91 handle, as there should be plenty of interest in being involved in a market that has broken out. Certainly, a lot of traders and watch this trade go by without taking advantage of the bullishness, and I feel that there will be plenty of people wanting to get involved in this market on some type of “value play.” Nonetheless, I don’t think it’s going to be easy, and I do recognize that just above where we are right now, is where we need to be in order to feel somewhat secure on the long side for any real length of time. I do think that this pair may have bottomed recently, and a move above the highs from the Friday session would confirm that for me.