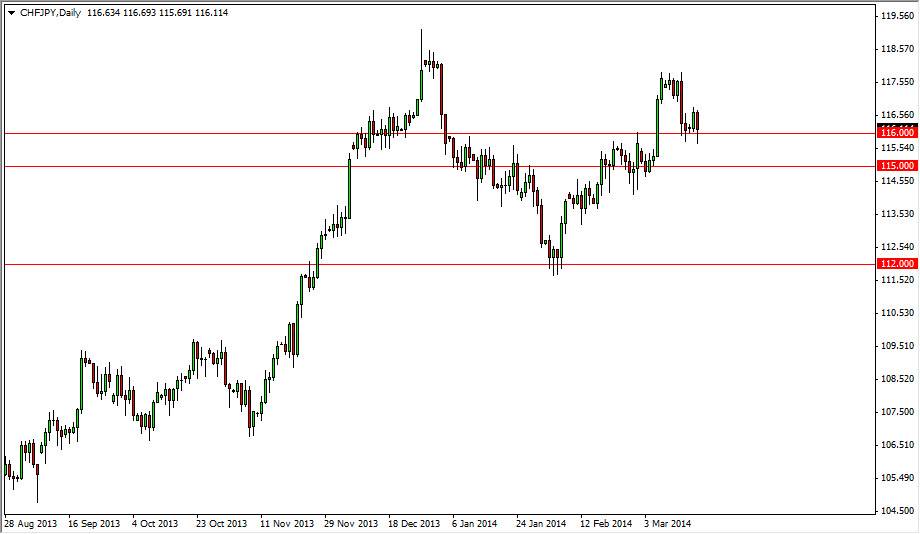

The CHF/JPY pair fell during the session on Tuesday, but found the 116 level to be supportive enough to push things back and form something along the lines of a hammer. This level is the top of a “zone of support” as far as I can tell, which of course extends down to the 115 level, if not as low as the 114 level. With that being said, I believe that we will have a nice buying opportunity on a break of the top of this hammer, and could see the market moves high as the 118 level without too many issues, and then ultimately the 120 level.

The Swiss franc is of course a safety currency, but not as much of a safety currency as the Japanese yen. Because of this, you have to keep in mind that this is a play on a relative strength. Granted, both currencies will continue to be bought when people get nervous, but at the end of the day the Japanese yen is the first one to be bought. So even while both currencies can rise, the Japanese yen should continue to rise much quicker than the Swiss franc. On top of that, this pair can also go higher as risk appetite increases, even though the Swiss franc itself isn’t necessarily something that people plow into when times are good.

Nice technical pattern, 120 seems to be calling.

I believe that this pattern that we are forming looks a lot like an upward channel, and as a result I believe that the buyers will continue to come back into this market over and over again. This market should attract a slow grind higher, because that’s essentially what this pair does: grind higher. It’s not one that you’re going to get massive profits and right away, but it does make for a good investment of sorts. Because of this, we should see this market continue to be bought every time it dips, and I believe that a fresh, new high is coming fairly soon. I like his pair a lot, because it is a very low stress and long-term type of environment.