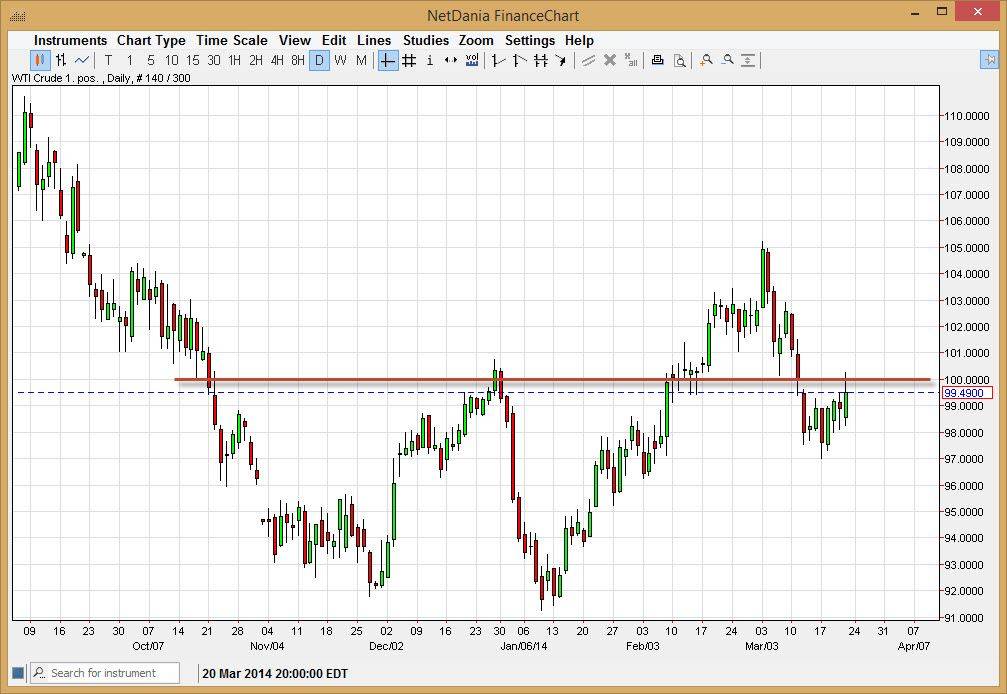

The WTI Crude Oil markets rose during the session on Friday, after initially gapping down just a little bit. At the end of the day, we had punctured the $100 level, but could not remain above it. While that suggests that there is in fact going to be a significant amount of resistance at the $100 handle, I still feel that this market will eventually go higher. One thing that you have to consider is that many traders will prefer to take profits before the weekend comes. This is going to be especially true as Russia continues to rock the headlines, and of course the Russians are a major source of crude oil.

Look at this chart, I see that we are just now trying to break out of a little bit of consolidation that we’ve been in for about a week or so. That being the case, I think that a break above the highs from the Friday session would be an Epson the market even higher, but I do recognize that there is a significant amount of resistance between $100 and $101. I still think he gets overtaken though, just simply because the most recent pullback was quite a bit shallower than a market that was falling apart would form.

$97 is crucial for me.

I believe that the $97 level below being supportive is a sign that the buyers are starting to take control again, and as a result I believe that the $97 level is a little bit of a “line in the sand” for the buyers as far as I can tell. That being the case, I believe that buying on short-term dips might be the way to go, just as a break above the aforementioned high from the Friday session.

I also believe that ultimately the $103 level is crucial, simply because it should be the next target. After that, I see this market going to the $105 level, but don’t kid yourself - a move higher is going to be difficult, just simply because of all of the noise above. However, for me I believe the momentum will win the day.