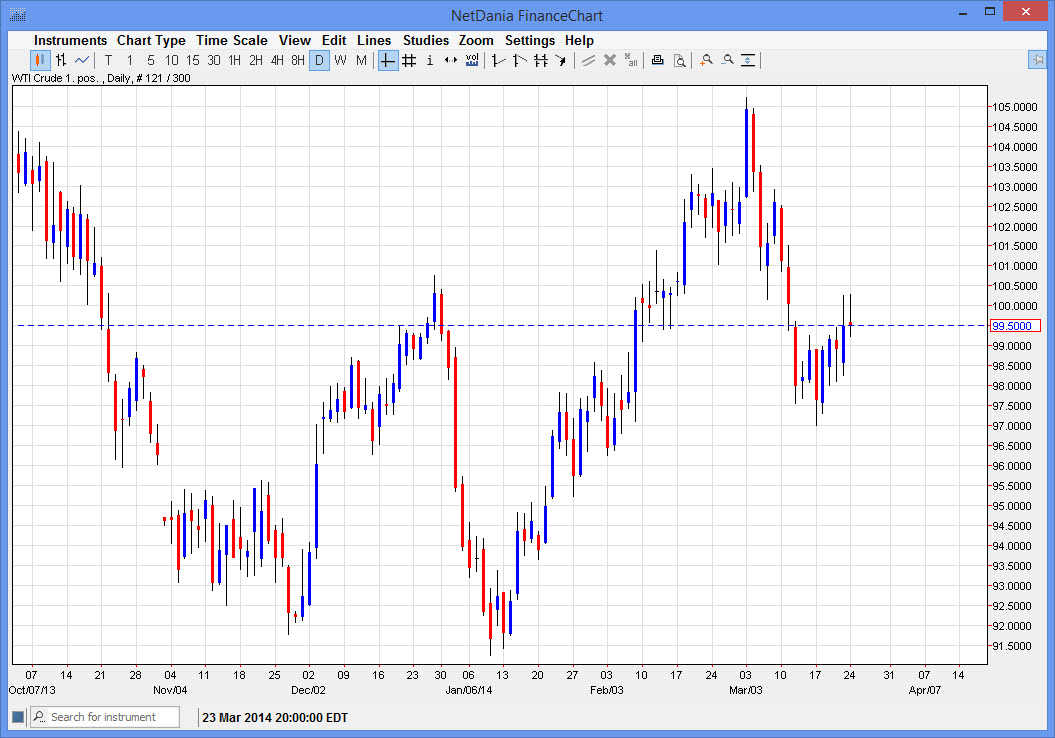

The WTI Crude Oil markets try to rally during the session on Monday, but as you can see the $100 level has offered a bit too much resistance for the second day in a row. Because of this, it appears that the market is in fact trying to break out, but is missing a bit as far as momentum is concerned. With that, we are the more than likely going to continue to consolidate as a pullback is suggested by the shooting star. The shooting star of course is technically a very sign, but I see so much in the way of noise between here and $97 and I’m very hesitant to sell this market. The market has pullback roughly 50% of the move from the bottom, and with that I believe that this market will continue higher. However, it’s obviously not quite ready to do so yet.

Headline driven

It is very possible that this market will be headline driven going forward, as Russia is a major exporter of that commodity. As long as there are troubles in the Crimea, there is going to be a possible move based upon headlines.

That being said, I still believe that we haven’t seen a move higher since January for a reason, and as a result we will eventually continue the move. A move above the $100.50 level to me would suggest that we have broken out above the resistance barrier, and at that point time we should head to the $103 level. Above the $103 level, I believe that will head to the $105 level given enough time.

Any pullback at this point time should be a nice buying opportunity, and I will be adding to my position when those pullbacks happen. I will do a small increments, as is market has been very volatile. However, if you have the ability to trade the CFD market, that might be the route to go just simply because of how much noise we have in the general vicinity. It is not until we clear the $95 level that I feel this market turns bearish again.