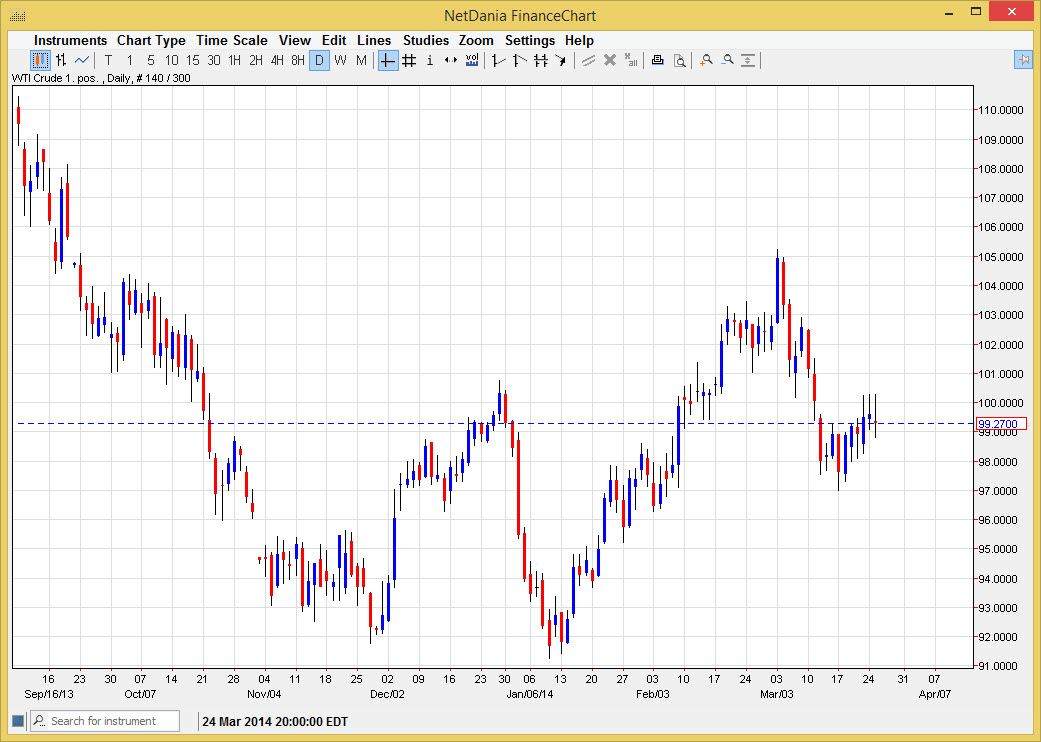

The WTI Crude Oil markets went back and forth on the session for Tuesday, as we continue to hover around the $99 handle. This is the epicenter of trading action at the moment as we had recently broke out above the $99 level, but as you can see we really can’t pick up enough momentum to break above the $100 level. That level looks to be enough resistance to keep the market down at the moment, and therefore making this almost an impossible trade to be involved in at the moment. Quite frankly, the only people that are making money in this market right now are people who have the ability to scalp well.

All things being equal though, I do believe that the market is eventually going to see bullishness come into play, and as a result I am much more interested in going long been short at this point in time. The pullback that we have seen recently extended all the way down to the $97 level, which is roughly the 61.8% Fibonacci retracement level. Because of this, I feel that there are buyers underneath, and as a result I think ultimately this market goes much higher.

Expect choppiness.

Regardless what happens, I believe that this market will continue to be very choppy. Ultimately, I believe that the market continues to grind its way higher, probably heading to the $103 level first, and then ultimately to the $105 level. With that, I think a breakout would be significant, probably heading as high as $110, but more than likely will take a significant amount of time as there are plenty of headlines to push the oil markets around in both directions.

Even mind that the Russians situation of course will have an influence on oil as well, simply because Russia is an exporter. Nonetheless, I believe that there are far too many reasons to think that oil will continue to go higher, and therefore we have no setup anytime soon that would have me interested in selling.