The EUR/USD pair has been grinding in a choppy manner to the upside for some time now, but what has concerned me about this pair is that there is no real clear movement in one direction or the other, except for the rare occasion. We don’t really have much of a trend, I mean you can make an argument for an uptrend over the last year or so, but this is not been the easiest market to hang onto.

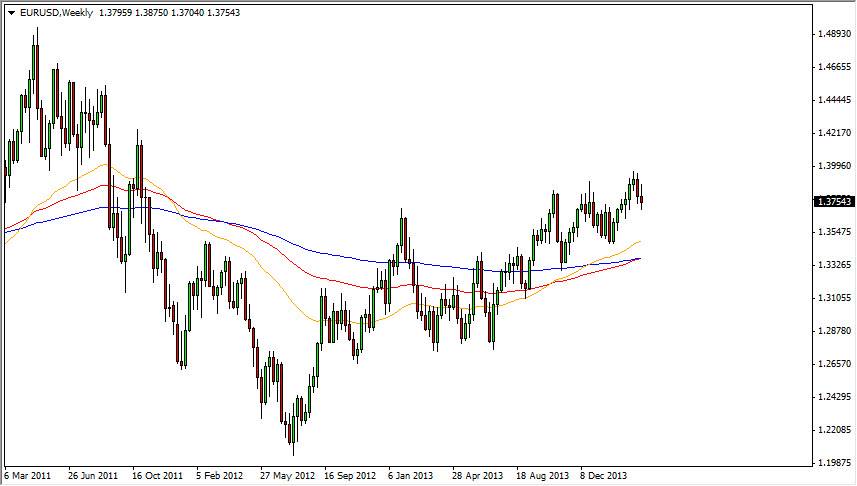

On the chart you will see I have three moving averages. They are the 50, 100, and 200 exponential moving averages for the weekly timeframe. I only put these up to get a general feeling as to what the attitude of the market might be right now. I typically don’t use moving averages, but I know a lot of people do. Because of this, some of the more common moving averages carry a bit of weight.

Possible moving average crossover.

The orange line it is the 50 EMA, while the red is the 100 EMA, with of course the blue being the 200 EMA. What this chart is starting to show me is that these moving averages are crossing over the 200 EMA, which of course suggests that we are starting to build momentum to the upside. The biggest problem of course is that even if we go higher, I don’t see anything on this chart that suggests to me that it won’t continue to be choppy.

I don’t like to waste my money and choppy markets, and I think that’s all were going to have. Granted, we could see some significant support come in at the 1.35 level if we do fall, but at the end of the day I still think going higher is going to be difficult as well. I believe this market will continue to bank around between about 1.36 and 1.39 for the month. This should continue to be a short-term trader’s type of market, and range bound trading techniques will more than likely have to be employed as I just don’t see anything to drive the market into one significant move or the other.