EUR/USD Signal Update

Yesterday’s signals were not triggered and expired.

Today’s EUR/USD Signals

Risk 0.50%.

Enter between 8am and 5pm London time today only.

Short Trade 1

Enter short after a next bar break of any bullish pin or engulfing hourly candle following the first touch of 1.3955. After an hour from the close of the first hourly candle that closes above 1.3955, this trade is no longer valid.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even at 1.3925. Remove 50% of the position as profit here and leave the remainder to ride.

Short Trade 2

Enter short after a next bar break of any bullish pin or engulfing hourly candle following the first touch of 1.3975. After an hour from the close of the first hourly candle that closes above 1.3975, this trade is no longer valid.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even at 1.3925. Remove 50% of the position as profit here and leave the remainder to ride.

Long Trade

Put a buy limit order for a long entry at the first touch of 1.3715.

Place the stop loss at 1.3680.

Remove 75% of the position in profit at 1.3820 and leave the remainder to run.

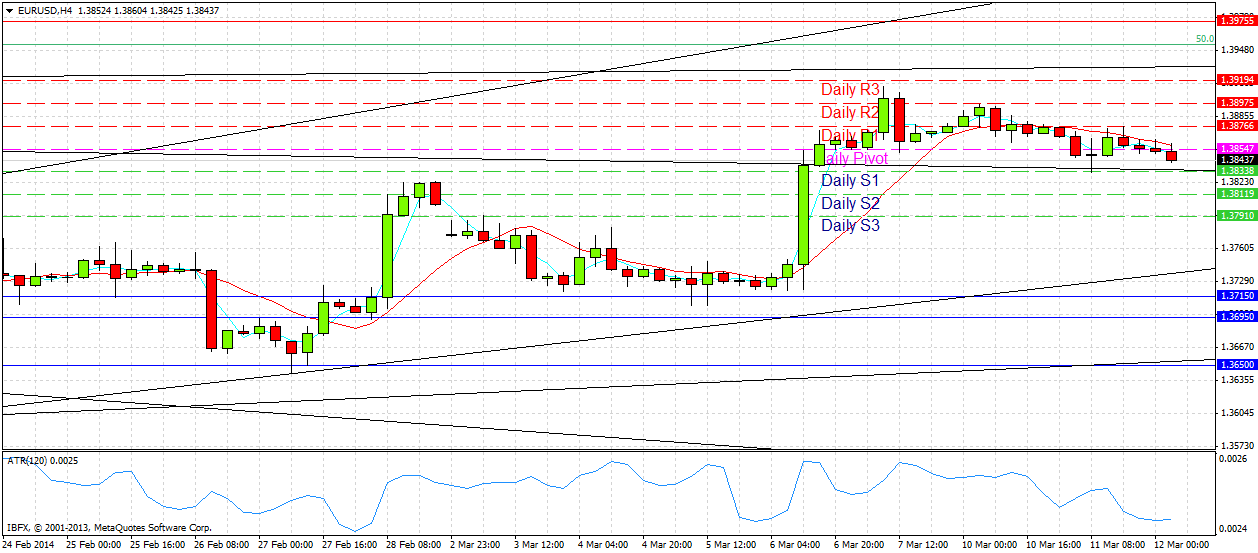

EUR/USD Analysis

As expected, yesterday was a quiet day and we did get a smallish bullish bounce off a retest of the broken trend line from the bullish side, as I had expected was likely to happen. Despite that, there is not a lot of energy within this pair right now, though it seems poised for another bullish move. The pair is stuck between the broken trend line and the resistance zone above 1.3900 and we await the next impulsive move in any direction before taking further steps. The trend line is confluent with today’s GMT S1 daily pivot point, which should add to its supportive strength.

I do not see any reason to exit yet from any long trade that might have been taken yesterday off the trend line retest. If there is a break down below the trend line, this would be a sign we are going back to 1.3715 at least.

A candlestick analysis of the higher time frames shows bullishness except mild bearishness on the daily chart if we break today below yesterday’s low price.

As mentioned yesterday, we are within a widening bullish channel:

There are no important data releases scheduled today concerning the EUR or the USD so it is likely to be another quiet day.