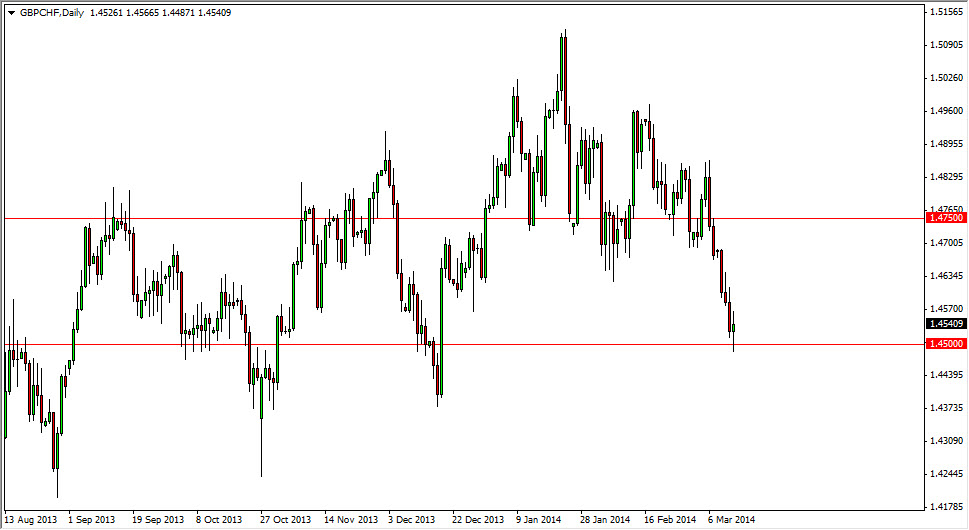

The GBP/CHF pair went back and forth during the session on Thursday, but interestingly enough found support at the 1.45 level. This is of course a large, round, psychologically significant number, so the bounce from there forming a hammer of course caught my attention. With that, I believe that this market could go much higher from here, as it could be begging for some type of bounce after a significant fall. It’s been somewhat of a massive and violent pullback, so at this point time it wouldn’t surprise me at all to see a bit of a bounce to perhaps the 1.47 level.

No market moves in one direction forever, and this move has been a bit strong for my liking. I believe that this area should offer a lot of buying opportunities simply because you can somewhat draw an uptrend line connecting the last four lows to what we just saw during the session on Thursday. With that, I believe that we are going to continue to see an overall bullish market, but a grinding one.

The British pound has been strong, and should continue to be overall.

The British pound has been strong for quite some time, and with that we should eventually see momentum move back in favor of it. I can even see this market going higher than that, binds the 1.47 level represents an area that was once a very massively supportive, so it should in fact be massively resistive now.

If we can get above the 1.4750 level, the market should continue to go back towards the 1.50 level. I know that there is plenty of resistance between here and there, so necessarily looking for that to happen right away, but I do think that there is a decent amount of trading opportunity here. Keep in mind that this market is very sensitive to risk appetite, so as stock markets around the world go higher, so this this pair. Of course, it works both ways so just look around the world and see what kind of general attitude we have, and a lot of times can give you a hint as to which direction this goes.