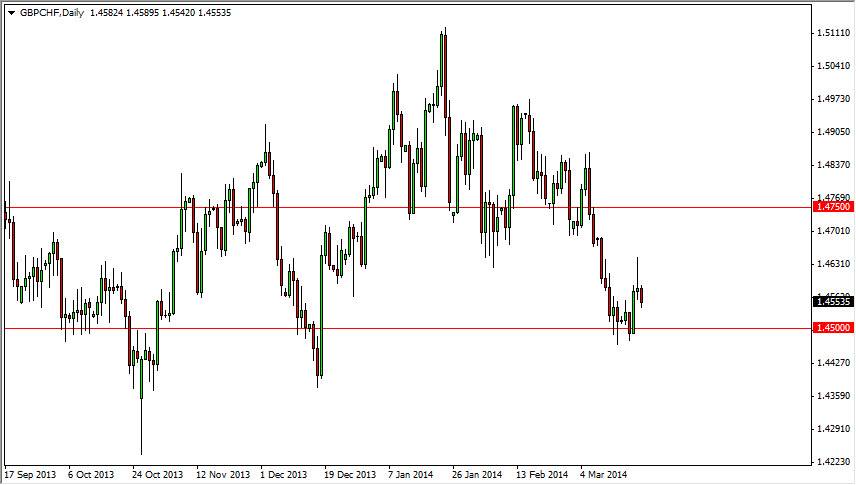

The GBP/CHF pair fell during the session on Friday, breaking the bottom of the shooting star that had formed on Thursday. This is a classic sell signal, but I do see that the 1.45 level below is going to offer plenty of support. It really isn’t until we get below there with significant follow-through of that I would be selling at this point in time. However, there is the possibility of finding support down at the 1.45 level, which would make sense and have me buying this market on the right candle. After all, if you look at the chart going all the way back to fall of 2013, you can see that the area between 1.45 and 1.44 as being really supportive.

Supportive candles in that general region would be a nice buying opportunity obviously, but the question then becomes how much farther can we go? I think that this market will eventually find its bottom again, but it seems as if we do need to test it a couple of more times.

Risk appetite matters

Risk appetite will matter in this particular pair, as it does tend to be influenced by it. The higher the risk appetite is, the higher this pair will go. I don’t know necessarily that we are going to get it, but there are other signs around there that suggests we could. However, if we get below the 1.44 level, I think that this market could really start to come undone. This pair does have a long history of choppiness around and then suddenly going hard in one direction or the other.

The one thing that I don’t like about selling this pair is the fact that the British pound itself has been generally strong over the last several months. Because of that, I am still much more comfortable buying supportive candles, but they have to be in the right place as per usual. Until then, expect a lot of choppiness between here and the 1.44 handle, but eventually I believe we will find our footing again.