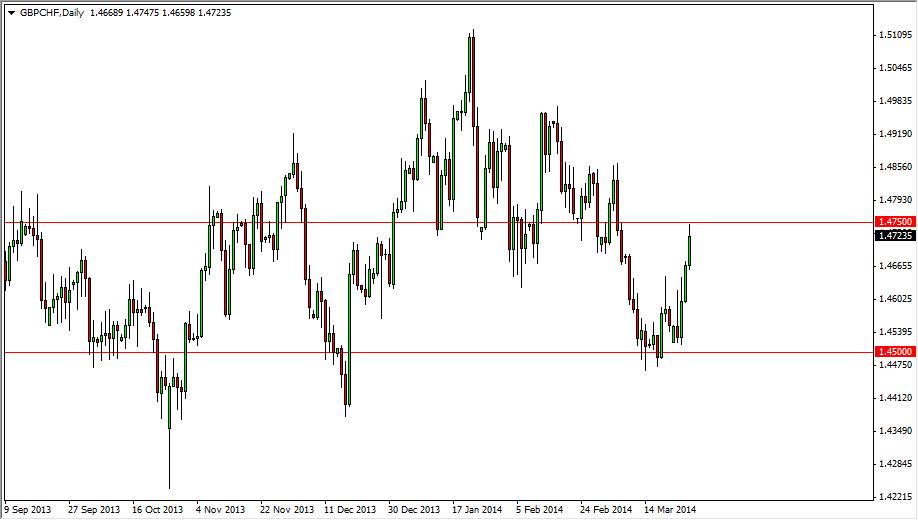

The GBP/CHF pair rose during the session on Thursday, slamming into the 1.4750 level again. This is an area that was once massively supportive, so that being the case I believe that we will see a significant amount resistance in this general vicinity. A pullback here is pretty likely, but at the end of the day you have to recognize the fact that this pair tends to follow overall risk appetite. If the market in general has a fairly decent amount of risk appetite in it, this pair will in fact go higher over time. On the other hand, if fear starts to run the market, you can expect this pair to pull back.

I don’t think that were going to break out right away, simply because I see quite a bit of resistance all the way to the 1.48 level. That is why I believe a pullback is more than likely going to happen, simply because it will allow the market to pick up more traders and build momentum to the upside.

Watch the world’s stock markets.

I typically will watch the world’s stock markets to decide how to trade this pair. I realize that the stock markets out there really don’t have a whole lot to do with either one of these currencies, but it’s just the general “risk on, risk off” type of feeling that tends to drive this market over the longer term. Without a doubt, the interest-rate differential favors the British pound, and while the Swiss franc tends to be a safety currency, that is why this market will move directly in correlation to what the world feels at the moment.

There is a lot of noise above anyway, so don’t expect a move higher to be regardless. I do think it will happen eventually though, simply because the British pound has been favored in general, and nobody truly likes hanging onto the Swiss franc given other choices. Going forward, I could see this market going as high as 1.50 in the interim, but recognize that there will be plenty of buying opportunities when we pullback.