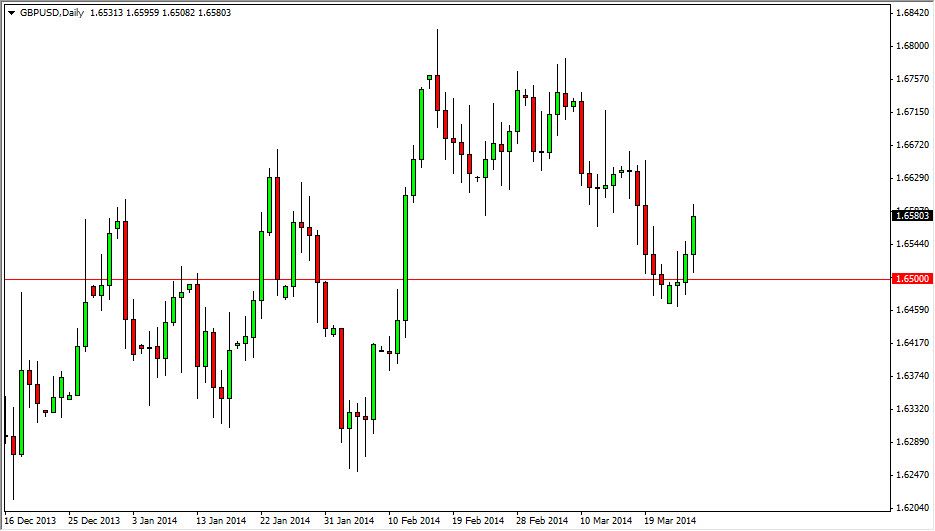

The GBP/USD pair initially fell during the session on Wednesday, but as you can see the 1.65 level did offer support. This support was strong enough to send the market higher, and form a pretty positive looking candle. There is no real name that I can put on this candle, it’s not a hammer, and it’s not a bullish engulfing candle, or anything like that. However, it does look positive and that’s really all that matters. After all, the 1.65 level was an area that I had anticipated being supportive previously, and it very well looks like it has been. The bounce from there has been reasonable, and in that I feel that the buyers are starting to step back into the marketplace.

I see a lot of noise just above though, so I feel that any move higher is probably going to struggle a bit. I don’t think that the market will ultimately fail above, just that the road to the 1.68 handle is going to be a little longer than some people might anticipate. Nonetheless, I am bullish overall of this market.

Two central banks

Two central banks are behind the scenes in this particular pair, both in a situation where they are essentially having to tighten monetary policy in offhand sorts of ways. Because of this, the British pound might do better against the US dollar than most other currencies, but the reality is that the US dollar isn’t exactly going to be weak. Because of this, I think this pair probably grind higher. I still ultimately believe that it’s going to the 1.70 level, but there is a line between here and there that will make this a choppy move.

Selling is an even a thought until we can get down below the 1.65 level for a significant amount of time, especially considering that I see potential for support all the way down to the 1.63 handle. With that in mind, I still like the British pound, and I do believe that by the end of summer we will more than likely see the 1.70 handle.