GBP/USD Signal Update

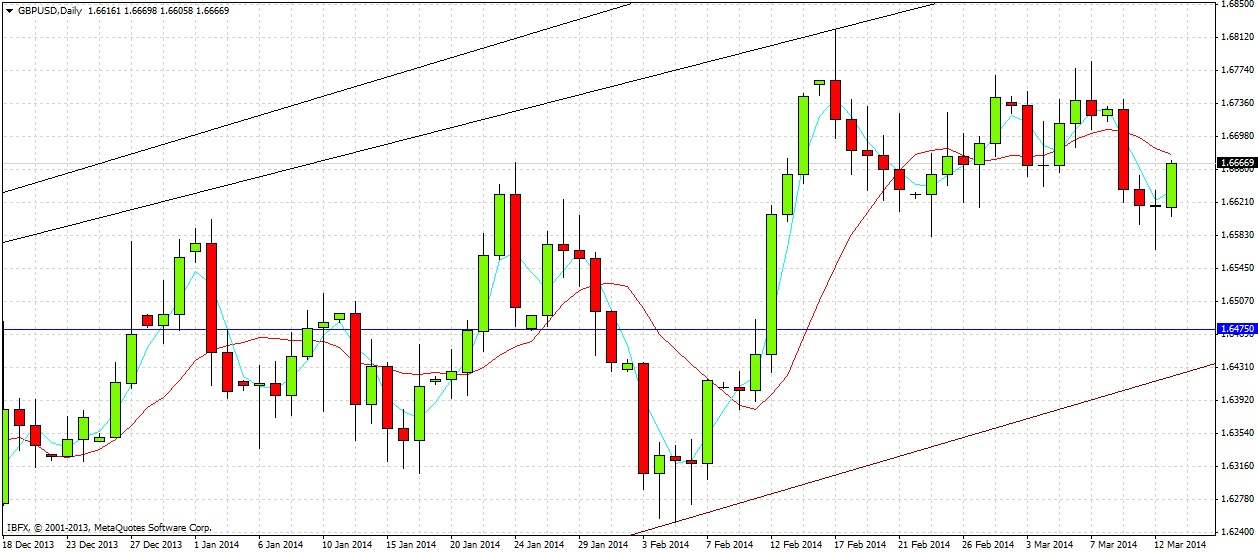

Yesterday’s signal expired without being triggered as the price did not reach 1.6475 during yesterday’s London session.

Today’s GBP/USD Signal

No signal is given today as the nearest interesting supportive and resistant levels respectively are too far away from the current price to be of interest.

GBP/USD Analysis

As yesterday began, it seemed that we were going to continue a downwards move by breaking a significant low established late last month. Things were looking bearish but following that break we had a rally, and a continued move up early this morning, late within the Tokyo session.

The upshot of all this is that we have conflicting bullish and bearish pressures fairly close by to where the price is now with some close battles over tight ranges. Although the daily chart printed a small pin bar yesterday, and today is looking bullish so far, I suspect we will next see a period of choppiness and consolidation rather than any continuing strong bullishness, so it is likely this pair could become less interesting to directional traders for a while. Having said that, even if it becomes choppy, some kind of upwards move within that is probably more likely than a downwards move at first.

The 1.6620 level seems used and no longer precise. The nearest obvious supportive level below that looks to be at around 1.6475. Above, there should be resistance at 1.6884.

A candlestick analysis shows a bullish picture on the monthly and daily time frames. The weekly time frame looks quite neutral.

We are within a wide, long-term bullish channel that has been established since November last year.

There are no important data releases scheduled today concerning the GBP. However there are three high-impact data releases concerning the USD that will occur simultaneously at 12:30pm London time: Core Retail Sales, Retail Sales, and Unemployment Claims. This is likely to mean that things will be quiet until around Noon London time when this pair should get more active.