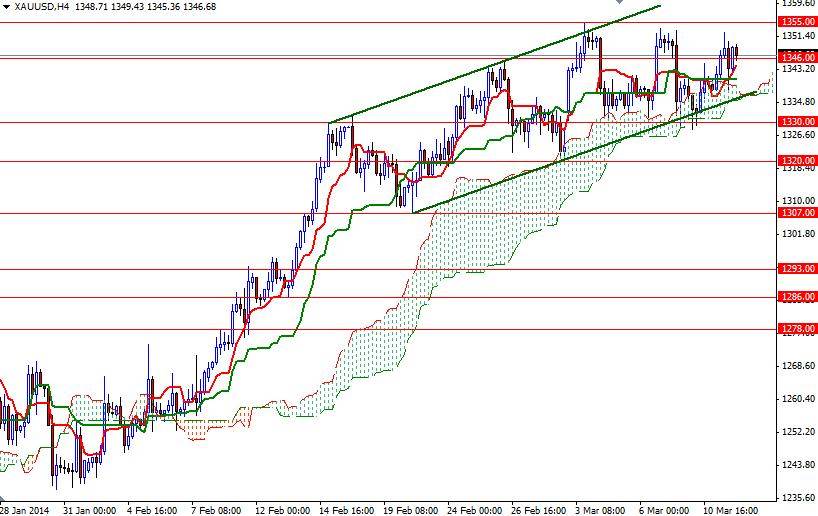

The XAU/USD pair (Gold vs. the American dollar) had a positive day as growing concerns over the Russian occupation of Crimea continued to attract buyers. Lately, the news from the region overshadowed gloomy economic reports out of China, the world's biggest gold consumer, and helped gold to bounce off of the 1330 support level where the bottom of the Ichimoku cloud on the 4-hour chart and the lower band of a bullish channel resided.

As people say “it is not the news but the market reaction to news that matters”. In my previous analysis, I had mentioned that the 1346 resistance level was the key to the upside and selling was not an option until we break below the 1330 support level. Although the bulls struggled to break through the 1355 level for four times last week, the bears lack the power and volume they need to dominate the market at the moment.

Technically, trading above the Ichimoku clouds (on both the daily and 4-hour time frames) gives the bulls an advantage so there might be some room for the pair to climb. It is quite possible that the pair will continue its bullish tendencies if the bulls can hold the market above the 1346 level and penetrate the resistance at 1355. If that is the case, I think the bulls will find a chance to test 1361.76.

Closing above this resistance level would suggest that the market will be heading towards 1375.20. However, if they bulls encounter heavy resistance and prices start to fall, I will pay attention to the support at 1337 (Fibonacci 61.8). Seller will have to capture this camp in order to challenge the bulls at the 1330 battle field. Breaching the 1320 support level, at least on a daily basis, is essential for a bearish reversal.