After falling 4 sessions in a row, the XAU/USD pair found some support on Friday and recovered some of its previous losses. Although the market settled higher on the last trading day of the week, the weekly candle was still negative. The pair declined %3.55 over the course of the week due to weakening demand for the precious metal as a hedge against geopolitical turmoil and long-side profit taking.

Last week's data out of the United States showed that the economy is in a better shape than market participants thought. Of course, Fed Chair Janet Yellen's comments on Wednesday, which raised the possibility of an early rate hike, added another element of interest to the most recent reports. Yellen’s timetable clearly surprised the markets but keep in mind that the Federal Reserve has been too optimistic about its economic projections in the past.

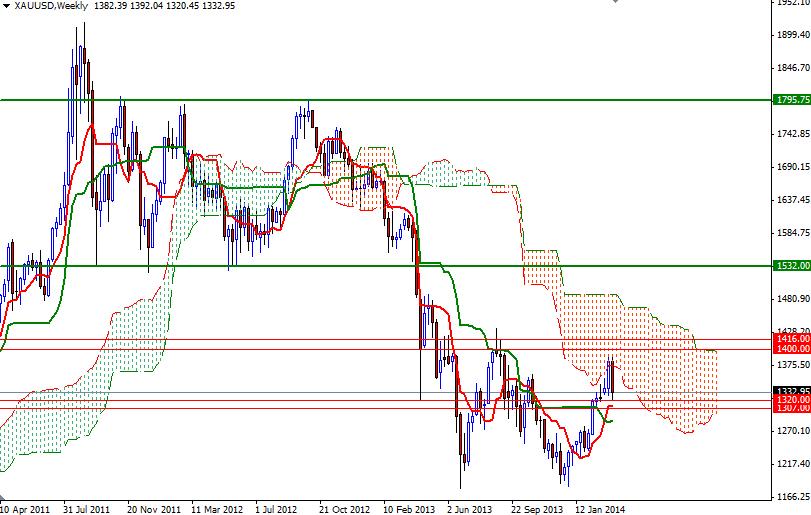

As I repeated before, “it is not the news but the market reaction to news that matters”. Technically, the weekly candle which almost engulfed the previous week's trading range doesn't look good for the bulls. The pair initially reached to a 6-month high of 1392 but on Thursday traded as low as 1320.45. For the next week, I expect to see a trading range roughly between 1352 and 1307.

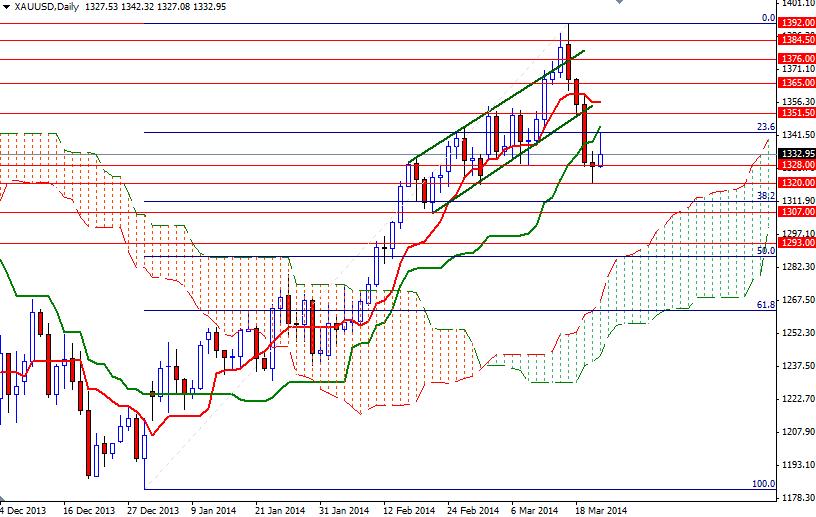

In order to ease the selling pressure and reach the 1352 resistance levels, the bulls have to push the pair above the Friday's high of 1327 which happens to be the 23.6 retracement level (based on the bullish run from 1182 to 1392. Only a sustained break above the 1352 level would suggest that the momentum is turning bullish and a retest of 1360/5 is on the table. However, if the bulls fail to defend the 1328/7 support level, it is likely that the pair will test the support at 1320. Once below that, the bears' next possible targets will be 1311 and 1307.