The XAU/USD pair fell to its lowest level in five weeks after weaker than expected figures from the United States and China fueled concerns about the global economy. According to data released by HSBC, preliminary index of China's manufacturing activity slipped to 48.1 from 48.5 while Markit reported that flash U.S. manufacturing PMI fell to 55.5 from 57.1. Since Chinese gold consumption plays an important role in this market, disappointing economic numbers from China tend to weigh on gold prices. The precious metal also faces pressure due to expectations of higher U.S. interest rates.

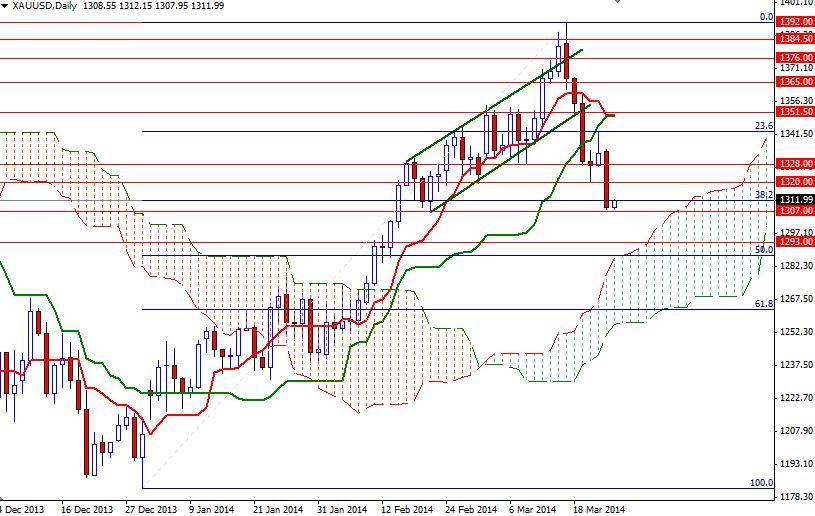

Last week, Federal Reserve Chair Janet Yellen said that rate hikes could begin around six months after the central bank ends its quantitative easing program. In my previous analysis, I have noted that the Ichimoku cloud on the weekly chart was the biggest hurdle for the bulls and the thickness of the clouds indicated heavy resistance. Eventually, we are back to the 1307 level and since it played a significant role (as both support and resistance) in the past, I can't eliminate the possibility of a bullish price action in the short term.

If this level remains intact and the XAU/USD pair manages to climb and hold above the 1312.50, we might see the bulls marching towards the 1316 - 1320 area. The bulls will have to break through that barrier in order to revisit the 1327/8 resistance. However, on the 4-hour time frame, the XAU/USD pair is trading below the Ichimoku cloud and we have a bearish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) cross.

Until this negative technical outlook changes, signs of weakness are what I am looking for. If prices break below 1307, we could possibly see the bears making a run for the 1300 level. Closing below 1300 would make me think that we are heading back to the 1293 level.