The XAU/USD pair (Gold vs. the American dollar) ended yesterday's session with a small gain as G7 nations threatened Russia with tougher economic sanctions. Lately falling prices put the precious metal back in the spotlights. Although some people think that the situation isn't going to resolve itself anytime soon, others choose to focus on the negative impact of rising U.S. interest rates as the economy reaches its full health.

Market volatility is expected to stay elevated while prices are driven by rumors and speculations. Yesterday, data from the world's biggest economy were mixed. The Commerce Department said sales of new homes fell 3.3% to an annualized pace of 440K homes from 455K and data released from the Conference Board showed that its consumer confidence index climbed to 82.3 from 78.3 the prior month.

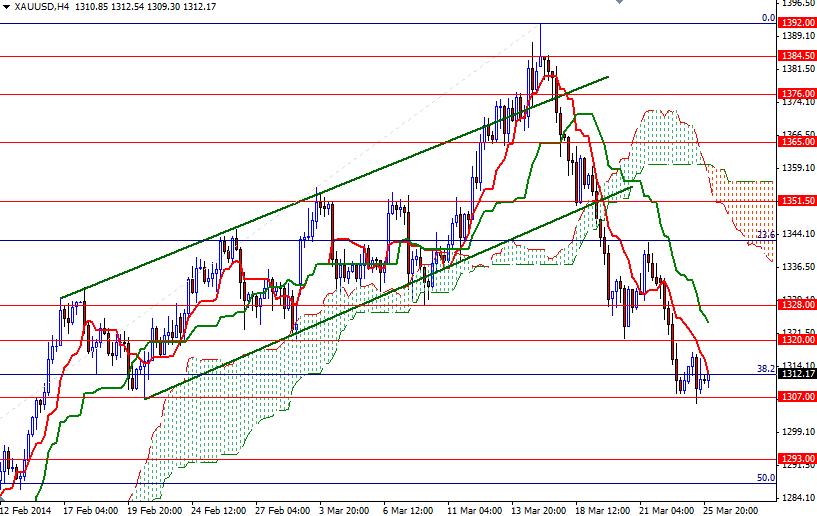

From a technical point of view, the broader directional bias remains weighted to the downside while prices remain below the Ichimoku cloud on the weekly time frame. On the other hand, Ichimoku clouds on the daily chart represent a support zone and the bears are coming closer to this major battlefield. In the short term, I think the key levels to watch will be 1307 and 1320. If the bears increase the downward pressure and drag gold prices below 1307, the pair may revisit the 1300 support level.

Breaking this support would suggest that the 1293 level will be the next stop. To the upside, I think the bulls might have another chance to test 1328/30 resistance zone if they manage to break and hold above 1320. Since this area caused the XAU/USD pair to reverse in the past, the bulls will need to break through in order to challenge the bears at 1339/42.