The XAU/USD pair closed lower than opening on Wednesday as the American dollar gained some traction after the durable goods orders and flash services PMI figures came in slightly better than expected. Data released from the Commerce Department showed that demand for durable goods increased by 2.2% in February and Markit reported that services business activity index rose to 55.5 in March from 53.3 a month earlier.

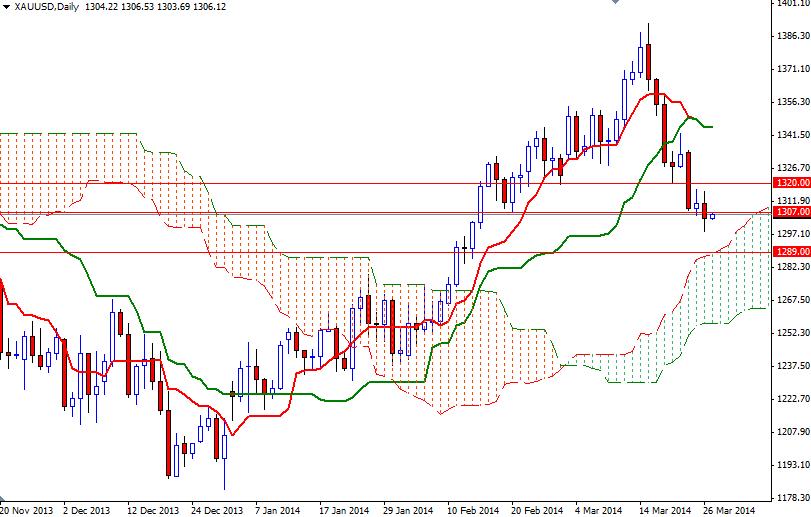

The pair traded as low as $1298.59 an ounce after breaking below the 1307 support level. Technical selling pressure had increased drastically since prices fell below the 1351.50 level which was the top of the previous consolidation area. This price movement has also caused 4-hour chart to turn bearish. As I mentioned in my previous analysis, last week's bearish engulfing pattern was an indication of lower prices.

Although gold prices fell approximately 2.18% this week, sellers should take caution as we approach the Ichimoku clouds on the daily chart. In order to attract new sellers to the market, the bears will need to drag prices below yesterday's low. In that case, support can be found at 1293 and 1289/6. If the bears clear the support at 1286, there is little to slow down the bears' progression until 1268. The bulls will have to defend the 1300 support level and push prices above the 1307 level to ease the recent pressure.

From a technical point of view, the first important hurdle gold needs to jump is located around the 1320 level. Only a close above 1320 would give the bulls extra power they need to tackle the 1328 resistance.