The XAU/USD pair printed another bearish candle yesterday as improving U.S. economic data dulled the precious metal’s safe-haven appeal. Fourth quarter GDP growth was revised up to 2.6% from 2.4% and data released by the Labor Department showed that the number of Americans who filed for unemployment insurance payment for the first time decreased by 10K to 311K, pointing to further strength in the labor market.

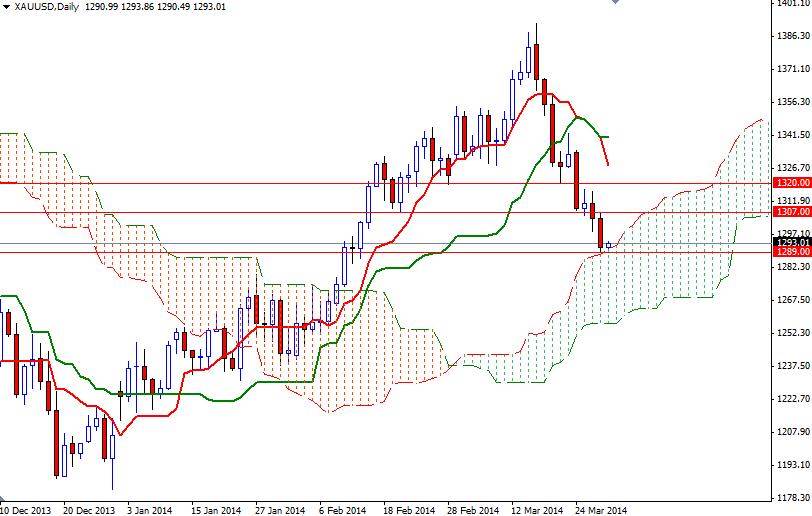

There has been a constant downward pressure on the shiny metal since Crimea's vote to join Russia passed without major violence and Federal Reserve Chief Janet Yellen suggested interest rates could start rising sooner than many investors had expected. Eventually the market pulled back to the 1289 level where the top of the Ichimoku cloud on the daily chart currently sits.

Technically, the Ichimoku cloud indicates an area of support or resistance and in our case clouds are representing a possible support zone. Because of that, I expect to see a bounce around here. Today I will be keeping an eye on the 1293 and 1289/6 levels. If the bulls manage to shatter this first barrier (and they are trying by the time I type), it is technically possible to witness a counter action towards the 1300 level.

They will have break through the 1300 resistance level in order to challenge the bears at 1307. A daily close above the 1307 resistance level indicates that the pair may extend its gains. However, if the bulls fail and prices drop below 1289/6 area (50% retracement based on the bullish run from 1182 to 1392), the market may visit the 1268 support level.