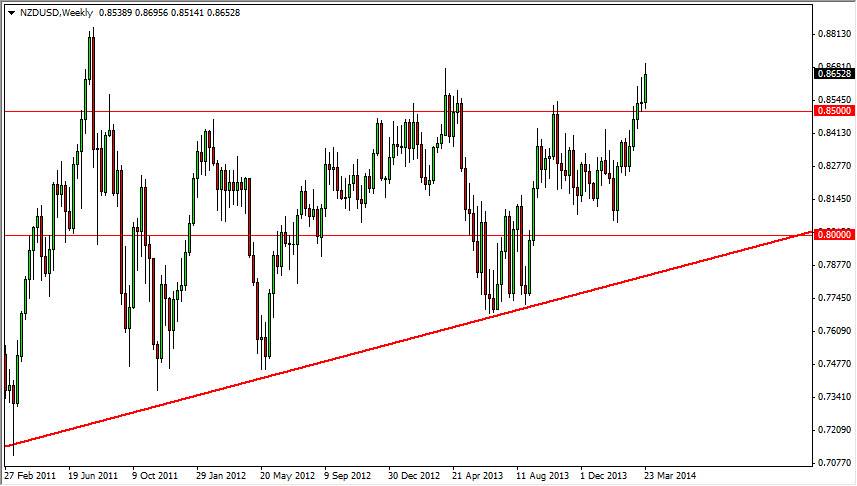

The NZD/USD pair has been going gangbusters lately, as the move has been relatively parabolic to the upside. The fact that we broke above the 0.85 level is of course important to me, as it is a large, round, psychologically significant number. However, you can see that we haven’t necessarily broken to fresh, new highs. It is because of this that I think although the market will be relatively positive for the month of April, you can probably expect some type of pullback in order to “refresh”, as we often see after a breakout.

Regardless though, the fact that on the weekly chart we have broken above a shooting star does tell me that there is a significant amount of buying pressure underneath. There will be traders that of course are losing money, so they will be more than grateful to cover their short positions in at the pullback, which of course will add to the buying pressure.

Watch the general attitude of world’s markets.

One of the best indicators for the New Zealand dollar simply how the world’s markets are behaving. While there is no one particular market you can attribute to drive in the New Zealand dollar, you have to keep in mind that it is an agricultural commodity-based exporting economy. Because of this, we need to pay attention to what’s going on in Asia as they are the largest customers of the Kiwis, as well as just the general attitude of commodities in general. By extension, you can see the same thing about stock markets, because as stock markets do better, people are generally out there looking for higher returns on their money. New Zealand is a favorite destination for exactly that type of trade because of the higher bond yields that are found in the country.

As far selling is concerned, I don’t think that this is a market that you should be thinking about selling. However, things get ugly all of a sudden if we do close below the 0.85 level, as I see it as being the potential support area now.