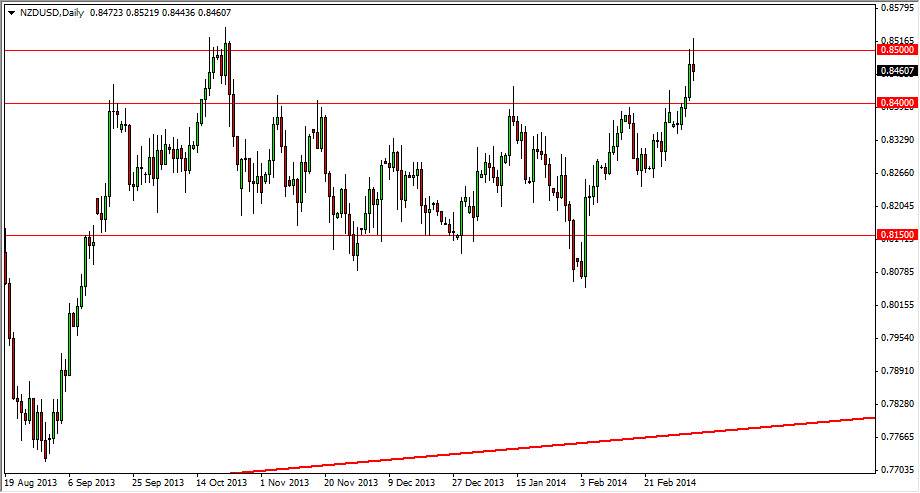

The NZD/USD pair rose during the session on Friday, but as you can see the 0.85 level offered far too much in the way of resistance. The resulting candle of course is a shooting star, which of course shows that there is a certain amount of resistance here, so having this market form the candle suggests to me that we are going back down to the 0.84 level.

I do believe that the 0.84 level is going to offer enough support to find buyers here, so I think that when we pullback we should get a decent buying opportunity, albeit for short-term. I think the 0.85 level will continue to be very difficult to deal with, and it will require a significant amount of good news over the longer term. I think it could be coming, but there is a lot of fear and noise out there to keep the markets volatile.

There is plenty of support below, so it’s only a matter of time.

With all this noise below, I believe that sooner or later we will find support and buyers to step into this market which has obviously formed a bit of a base now. There should be plenty of buyers based upon the commodity markets as well, as there is a certain amount of “risk on” suddenly appearing in the markets every time that the Russians and Ukrainians look like they’re going to come to terms. There will continue to be a lot of noise, but in the end there is far too much in the way of bullishness in the stock markets as well for me to think that this market is going to collapse.

It really isn’t until we get below the 0.82 level that we can even begin to think about selling in my opinion. After all, there is so much in the way of support below that it would take at least that to get through the majority of it. The 0.80 level of course would be the ultimate support, but I cannot believe we are can be anywhere near there anytime soon.